If you are looking for a professional tax preparer in Newark, NJ who combines technical accuracy, strict IRS compliance, and a clear understanding of local New Jersey tax rules, Precision Accounting Intl provides the level of service serious taxpayers expect. We are a CPA firm in New Jersey serving individuals, families, and businesses throughout the City of Newark, NJ and surrounding communities.

Tax preparation is not only about filing a return. It is about accuracy, documentation, compliance, and long-term tax efficiency. Our firm approaches every engagement with the mindset of protecting our clients today while positioning them for stronger financial outcomes in the future.

Why Choose Precision Accounting intl as a Newark Tax Preparer

Choosing a local Newark tax preparer gives you access to professional insight that national chains and online platforms often miss. State and municipal tax considerations directly affect compliance, deductions, and risk exposure.

Clients work with Precision Accounting Intl because we provide:

- Extensive experience with New Jersey tax laws and filing requirements

- Practical knowledge of Newark property taxes and municipal tax considerations

- Personalized service from licensed CPAs and IRS-authorized tax professionals

- Ongoing availability and accountability beyond tax season

Unlike directory-listed preparers or national storefront chains, our firm provides direct CPA oversight on every return. Clients work with professionals who understand their history, their filings, and their long-term tax position.

You may need a tax preparer in New Jersey

Our Comprehensive Tax Preparation Services

We serve a wide range of tax profiles with structured, compliant, and professionally managed tax preparation services.

Tax Preparation for Individuals

We prepare and electronically file federal and New Jersey state income tax returns with close attention to accuracy and refund optimization. Our individual tax services include:

- Form 1040 preparation and review

- Deduction and credit analysis

- Prior-year return review and corrections

- Filing for employees, retirees, and investment income earners

Each return is prepared with a focus on compliance and documentation, not shortcuts.

You may need: CPA in Newark, NJ

Tax Returns for Businesses and Self-Employed Professionals

Business and self-employed taxpayers face more complex filing requirements and higher audit exposure. We prepare returns for:

- Schedule C self-employed individuals

- Partnerships and multi-member LLCs

- S corporations and closely held businesses

Our team ensures proper income classification, expense substantiation, and alignment with IRS and New Jersey regulations.

Corporate and Partnership Returns

For established entities, we provide tax preparation for businesses services integrated with your accounting records and future tax planning goals. These services include:

- Corporate income tax return preparation

- Partnership allocations and K-1 reporting

- Coordination of multi-state considerations when applicable

ITIN and Non-Resident Tax Filing

We assist individuals and families who require tax filing using an Individual Taxpayer Identification Number (ITIN). Our firm ensures accurate reporting and compliance with federal and New Jersey tax regulations for non-resident and international taxpayers.

Credentials and Qualifications You Should Expect From a Tax Preparer

Not all tax preparers operate under the same professional standards. Precision Accounting Intl is a CPA firm in New Jersey, which means our work is governed by professional ethics, continuing education requirements, and regulatory accountability.

When you work with us, you benefit from:

- Direct involvement of a Certified Public Accountant

- IRS Preparer Tax Identification Number authorization

- Experience handling IRS correspondence and audit inquiries

- Ongoing training in federal and state tax compliance

This level of qualification is critical when accuracy, documentation, and audit readiness matter.

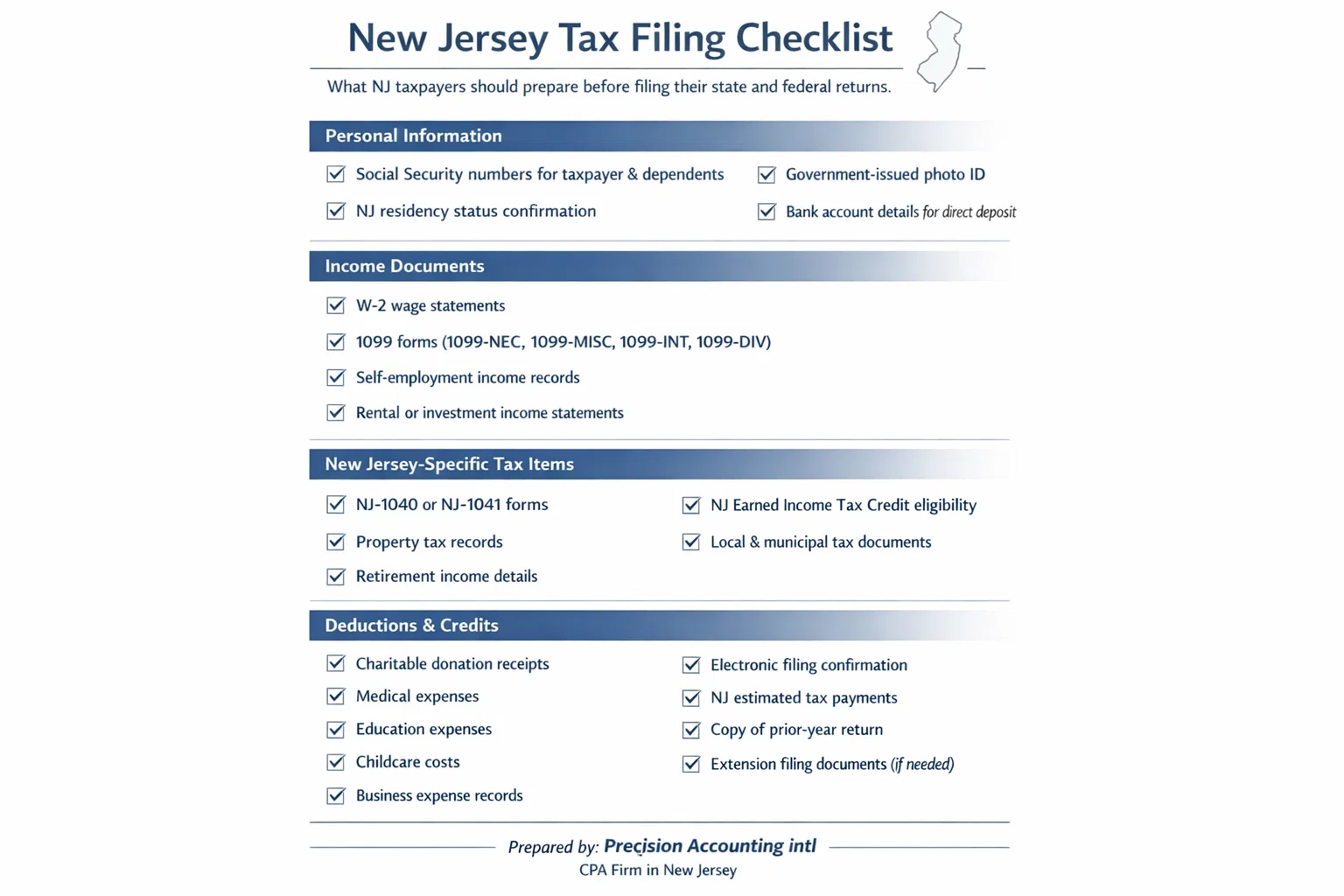

What to Bring to Your Tax Appointment

Key Tax Documents Checklist

Preparing your documents in advance helps ensure a smooth and efficient tax preparation process. Most clients should be ready to provide:

- W-2 and 1099 forms

- Prior-year tax returns

- Records of business income and expenses

- City of Newark, NJ property tax statements, if applicable

- Receipts supporting deductions and tax credits

Our team carefully reviews your documentation to identify missed deductions and reduce compliance risks.

Know more about: Who is eligible for the NJ property tax relief credit?

Our Tax Preparation Process

Our tax preparation process is structured, professional, and designed to minimize errors while maximizing clarity.

Initial Consultation

We review your tax situation, filing requirements, and any potential risk areas.

Document Review and Analysis

All documents are reviewed by a CPA to ensure completeness and accuracy.

Preparation and Quality Review

Returns are prepared and reviewed under CPA supervision to meet compliance standards.

Electronic Filing and Confirmation

We securely file your return and provide confirmation along with guidance on next steps.

Transparent Pricing and Real Value

Tax preparation fees are based on complexity, not guesswork. At Precision Accounting Intl, pricing is determined by:

- Type of return being filed

- Individual or business complexity

- Number of required schedules and forms

We do not advertise artificially low prices that increase later. Our pricing reflects professional expertise, accountability, and long-term value.

More Resources & Services

- small business preparer nj

- why outsource bookkeeping services in NJ

- are bookkeeping services taxable

- what is bookkeeping service

- types of bookkeeping services

- small business bookkeeping checklist

- How to do bookkeeping for NJ restaurants?

- what is quickbooks

- Quickbooks services in new Jersey

- best accounting firm in nj

- year end tax planning for businesses

- bookkeeping services in new Jersey

- tax relief service near nj

- retirement planning in NJ

- part-time cfo services

- business tax services

- indivedual tax services new jersey

- payroll near you in NJ

- online service bookkeeping usa

- tax accountant nj

- Amr Ibrahim, CPA

What Newark Clients Say About Precision Accounting Intl

Clients across Newark and New Jersey value our professionalism, transparency, and precision. Many come to us after working with unlicensed preparers or national chains and stay because they experience the difference CPA-level service provides.

See what they said about Precision Accounting intl within Google Reviews.

Schedule Your Newark Tax Preparation Consultation

If you need a tax preparer in Newark, NJ who prioritizes compliance, precision, and taxpayer protection, Precision Accounting Intl is ready to help.

Schedule a private consultation with our team and experience the confidence of working with a CPA-led New Jersey accounting firm.

Tax Preparation Frequently Asked Questions in Newark, NJ

How far back can I file prior-year tax returns?

In many cases, prior-year returns can be filed going back several years. We review eligibility and compliance requirements before proceeding.

Do you assist with IRS letters or notices?

Yes. We help clients respond to IRS correspondence and address compliance issues when needed.

Can you help reduce my tax liability legally?

Yes. Proper deduction planning and accurate income classification are core parts of our service.