As a business owner, managing your finances effectively is crucial for success. But are you doing it right?

A well-organized bookkeeping system helps you make informed decisions, ensures tax compliance, and supports business growth. At Precision Accounting Intl., we understand the importance of accurate financial record-keeping and offer customized solutions to support your needs.

small business bookkeeping checklist

In this comprehensive guide, we will walk you through the essential tasks and provide tips to help you stay on top of your finances.

Key Takeaways

- Understand the importance of a bookkeeping checklist for your business

- Learn how to manage your finances effectively

- Discover tips for ensuring tax compliance

- Explore customized bookkeeping solutions

- Find out how to support your business growth with accurate financial records

Why Proper Bookkeeping Is Essential for Small Business Success

Proper bookkeeping is the backbone of any successful small business, providing a clear financial picture that guides decision-making. By maintaining accurate and up-to-date financial records, small businesses can reap numerous benefits that contribute to their overall success.

Before diving into specific tasks, it helps to understand what is bookkeeping service in NJ and how it supports your financial infrastructure year-round.

The Financial and Legal Benefits of Organized Bookkeeping

Organized bookkeeping offers several financial and legal advantages. It ensures compliance with tax regulations, reducing the risk of audits and penalties.

Tax Compliance and Audit Protection

Accurate financial record-keeping helps small businesses stay on top of their tax obligations, minimizing the risk of non-compliance. This, in turn, protects them from potential audits and associated penalties.

If your business is facing IRS issues or outstanding liabilities, seeking professional tax settlement services near you can help resolve disputes efficiently and avoid penalties.

Informed Business Decision Making

With a clear picture of their financial situation, small business owners can make informed decisions about investments, funding, and resource allocation. This enables them to drive their business forward with confidence.

How Good Bookkeeping Practices Support Business Growth

Good bookkeeping practices are essential for supporting business growth. They enable small businesses to manage their finances effectively, identify areas for improvement, and make strategic decisions.

Accurate Cash Flow Management

Effective bookkeeping allows small businesses to track their cash flow accurately, ensuring they have sufficient funds to meet their financial obligations.

Building Credibility with Lenders and Investors

By maintaining accurate and transparent financial records, small businesses can demonstrate their credibility to lenders and investors, making it easier to secure funding when needed.

| Benefits of Proper Bookkeeping | Description | Impact on Business |

| Tax Compliance | Accurate financial records ensure tax obligations are met | Reduces risk of audits and penalties |

| Informed Decision Making | Clear financial picture guides business decisions | Drives business growth and profitability |

| Cash Flow Management | Effective tracking of cash inflows and outflows | Ensures financial stability and growth |

By prioritizing bookkeeping for small businesses, owners can ensure their financial record keeping is accurate and reliable, setting their business up for long-term success.

To streamline your financial management and support sustainable growth, consider exploring bookkeeping services in Clifton NJ tailored to meet your small business needs.

Setting Up Your Small Business Bookkeeping System

Establishing a robust bookkeeping system is crucial for the financial health and success of your small business. This foundational step enables you to track your financial transactions, manage cash flow, and make informed decisions.

Choosing Between Cash and Accrual Accounting Methods

One of the first decisions you'll need to make when setting up your bookkeeping system is choosing between the cash and accrual accounting methods. Each method has its benefits and limitations, which are crucial to understand to make an informed decision.

Benefits and Limitations of Each Method

The cash accounting method records transactions when cash is received or paid, making it simpler and more straightforward. However, it may not accurately reflect your business's financial position, especially if you have a lot of accounts receivable or payable.

The accrual method, on the other hand, records revenues and expenses when they are earned or incurred, regardless of when the cash is received or paid. This method provides a more accurate picture of your business's financial performance but can be more complex to manage.

| Accounting Method | Benefits | Limitations |

| Cash | Simple, straightforward | May not accurately reflect financial position |

| Accrual | More accurate financial picture | More complex to manage |

Essential Bookkeeping Software Options for Small Businesses

Selecting the right bookkeeping software is vital for efficiently managing your financial transactions. Cloud-based solutions offer greater flexibility and scalability compared to traditional desktop applications.

If you’re wondering what is QuickBooks used for, it’s a powerful tool for managing invoices, tracking expenses, and reconciling bank statements efficiently.

Cloud-Based vs. Desktop Solutions

Cloud-based bookkeeping software allows you to access your financial data from anywhere, at any time, and often comes with automatic backups and enhanced security features. Desktop solutions, while more traditional, may require manual backups and can be less flexible.

Creating Your Chart of Accounts

A well-structured chart of accounts is essential for organizing your financial transactions and generating meaningful financial reports. It's crucial to consider industry-specific considerations when creating your chart of accounts.

Industry-Specific Considerations

Different industries have unique financial reporting requirements. For example, a retail business may need to track inventory levels, while a service-based business may focus more on tracking time and expenses. Tailoring your chart of accounts to your industry's needs will help you better manage your finances.

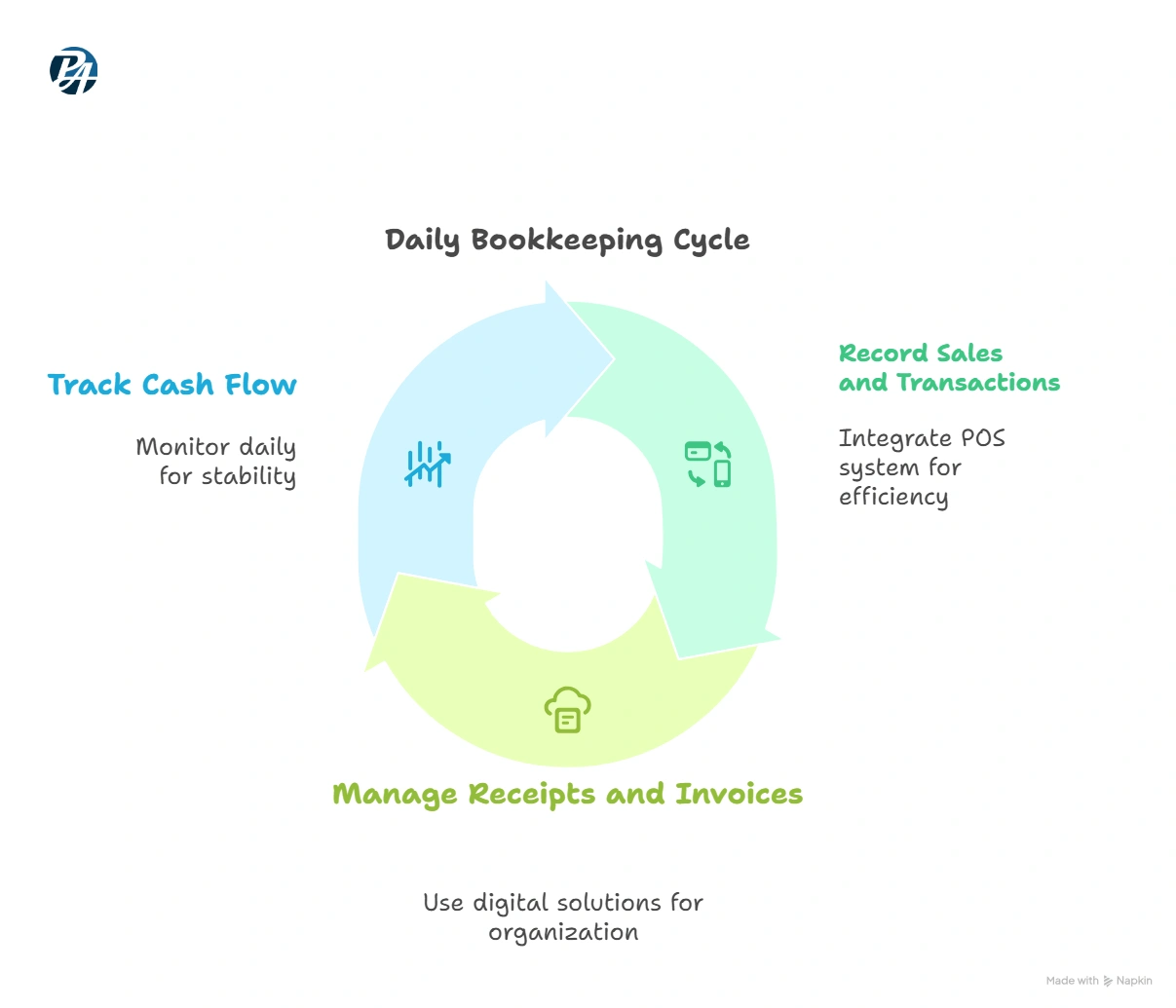

Daily Bookkeeping Tasks for Small Businesses

To maintain accurate financial records, small businesses must perform daily bookkeeping tasks. This includes recording sales and transactions, managing receipts and invoices, and tracking cash flow. By doing so, businesses can ensure they have a clear picture of their financial health.

Recording Sales and Transactions

Recording sales and transactions daily is vital for maintaining up-to-date financial records. Integrating your point-of-sale system with your bookkeeping software can simplify this process.

Point-of-Sale Integration Tips

- Choose a POS system that integrates with your bookkeeping software.

- Set up automatic transaction recording to minimize manual entry.

- Regularly review transactions for accuracy.

Managing Receipts and Invoices

Managing receipts and invoices digitally helps businesses stay organized. Digital receipt management solutions can reduce the risk of lost or misplaced documents.

Digital Receipt Management Solutions

Consider using cloud-based storage for receipts and invoices. This allows for easy access and retrieval.

Tracking Cash Flow

Monitoring cash balance daily enables businesses to identify discrepancies and take corrective action. Daily cash balance monitoring is essential for maintaining financial stability.

| Daily Task | Benefit |

| Record sales and transactions | Accurate financial records |

| Manage receipts and invoices digitally | Reduced risk of lost documents |

| Monitor cash balance daily | Improved financial stability |

Weekly Small Business Bookkeeping Checklist

To keep your small business financially healthy, implementing a weekly bookkeeping checklist is essential. This regular review helps in maintaining accurate financial records, ensuring timely payments, and making informed business decisions.

Accounts Receivable Review

Regularly reviewing your accounts receivable is crucial for maintaining a healthy cash flow. This involves checking outstanding invoices and following up with customers.

Following Up on Outstanding Invoices

Prompt follow-up on outstanding invoices can significantly reduce delays in payment. Implementing a systematic follow-up process can help in getting paid on time.

Accounts Payable Management

Managing your accounts payable effectively is vital for maintaining good relationships with suppliers and avoiding late payment penalties.

Scheduling Upcoming Payments

By scheduling upcoming payments, you can ensure that you have sufficient funds and avoid any potential cash flow issues. This proactive approach helps in maintaining a smooth financial operation.

Employee Expense Tracking

Tracking employee expenses is essential for understanding where your business money is going and identifying areas for cost reduction.

Expense Approval Workflows

Implementing an expense approval workflow can streamline the process of managing employee expenses. This ensures that expenses are properly authorized and recorded in your bookkeeping system.

By incorporating these weekly bookkeeping tasks into your routine, you can maintain a clear picture of your financial situation and make better decisions for your business. For professional assistance with bookkeeping and financial management, consider reaching out to experts like Precision Accounting Intl.

Monthly Bookkeeping Tasks Every Small Business Should Complete

Effective financial management is the backbone of any successful small business, with monthly bookkeeping tasks playing a pivotal role. By dedicating time each month to organizing your finances, you can ensure accuracy, make informed decisions, and stay on top of your business's financial health.

There are several types of NJ bookkeeping services available to small businesses, from basic data entry to advanced financial reporting, and each plays a unique role in your accounting cycle.

Bank and Credit Card Reconciliation

Reconciling your bank and credit card statements monthly is crucial for identifying discrepancies and ensuring your financial records are accurate. This process involves comparing your internal financial records against the statements provided by your bank or credit card company.

Identifying and Resolving Discrepancies

When discrepancies are found, it's essential to investigate and resolve them promptly. This might involve correcting errors in your records, contacting your bank to report unauthorized transactions, or adjusting your accounts to reflect the correct financial position.

Financial Statement Review

Regular review of your financial statements is vital for understanding your business's financial performance. This includes examining your balance sheet, income statement, and cash flow statement to get a comprehensive view of your financial situation.

Key Performance Indicators to Monitor

As part of your financial statement review, focus on key performance indicators (KPIs) such as revenue growth, profit margins, and cash flow. Monitoring these KPIs will help you make informed decisions and adjust your business strategies as needed.

For deeper financial insights without the overhead cost, many businesses benefit from part-time CFO services that offer strategic financial oversight and planning.

Inventory Management

For businesses that hold inventory, conducting regular stock checks is essential. This helps in identifying any discrepancies between your recorded inventory levels and the actual stock on hand.

Conducting Physical Inventory Counts

Monthly or periodic physical inventory counts can help you maintain accurate inventory records. This process involves physically counting your stock and comparing it against your recorded inventory levels to identify any discrepancies.

Payroll Processing

Accurate and timely payroll processing is critical for maintaining employee satisfaction and ensuring compliance with tax regulations. This includes calculating salaries, deductions, and taxes, as well as making timely payments.

Tax Withholding and Compliance

As part of your payroll processing, ensure that you're correctly withholding taxes from employee wages and complying with all relevant tax laws and regulations. This includes filing necessary tax returns and making required payments to tax authorities.

By completing these monthly bookkeeping tasks, small businesses can maintain financial accuracy, ensure compliance with regulations, and make informed decisions to drive growth. For expert guidance on managing your small business's finances, consider consulting with professionals like Precision Accounting Intl, who can provide comprehensive small business accounting tips and support with small business tax preparation guide services.

Quarterly Financial Management for Small Businesses

Quarterly financial management tasks are essential for small businesses to make informed decisions and drive growth. By regularly reviewing their financial performance, small businesses can identify areas for improvement, adjust their strategies, and stay on track to meet their financial goals.

Tax Estimation and Planning

One crucial aspect of quarterly financial management is tax estimation and planning. Small businesses must estimate their tax liability each quarter to avoid penalties and interest.

For precise quarterly estimations and compliance, consider utilizing business tax services in NJ designed for small businesses.

Quarterly Tax Payment Schedules

To comply with IRS regulations, small businesses should adhere to the following quarterly tax payment schedule:

| Quarter | Payment Due Date |

| January 1 - March 31 | April 15 |

| April 1 - May 31 | June 15 |

| June 1 - August 31 | September 15 |

| September 1 - December 31 | January 15 (of the next year) |

Profit and Loss Analysis

Regular profit and loss analysis helps small businesses understand their financial performance and make data-driven decisions.

Identifying Seasonal Trends

By analyzing their profit and loss statements, small businesses can identify seasonal trends and adjust their strategies accordingly. For instance, a business with a seasonal spike in sales during the holiday season can prepare by increasing inventory and staffing during that period.

"Understanding your cash flow and being able to predict your financial needs is crucial for the success of any small business." -

Financial Expert

Budget Review and Adjustment

Quarterly budget reviews enable small businesses to align their expenses with revenue projections and make necessary adjustments.

As part of your long-term financial strategy, it’s wise to consult professionals offering retirement planning near you to align business goals with your future personal needs.

Aligning Expenses with Revenue Projections

By regularly reviewing their budget, small businesses can identify areas where they can cut costs or reallocate funds to support growth initiatives.

Effective quarterly financial management is key to the success of small businesses. By focusing on tax estimation and planning, profit and loss analysis, and budget review and adjustment, small businesses can stay on top of their finances and drive growth.

The Complete Small Business Bookkeeping Checklist

To wrap up the year on a financially strong note, small businesses should focus on completing a thorough small business bookkeeping checklist. This comprehensive checklist will help ensure that your financial records are accurate, up-to-date, and compliant with regulatory requirements.

Incorporate year end tax planning for businesses into your checklist to take advantage of deductions and avoid unexpected tax liabilities.

Year-End Financial Statement Preparation

Preparing your financial statements at the end of the year is crucial for understanding your business's financial health. This includes:

- Verifying your balance sheet to ensure accuracy and completeness

- Analyzing your income statement to identify trends and areas for improvement

Balance Sheet Verification

Verify that your balance sheet is balanced and accurately reflects your business's financial position. This involves checking your assets, liabilities, and equity to ensure that they are correctly recorded and reconciled.

Income Statement Analysis

Review your income statement to understand your business's revenue, expenses, and profitability. This analysis will help you identify areas where you can improve your financial performance in the coming year.

Tax Documentation Organization

Organizing your tax documentation is essential for meeting tax deadlines and avoiding penalties. Ensure that you have all the necessary forms and supporting documents, and that you are aware of the relevant deadlines.

Working with a qualified tax accountant New Jersey ensures your filings are accurate and submitted on time, minimizing stress during tax season.

Required Forms and Deadlines

Familiarize yourself with the tax forms required for your business, such as Form 1040 or Form 1120, and ensure that you understand the filing deadlines. This will help you avoid late filing penalties and ensure compliance with tax regulations.

Business Performance Review

Conducting a thorough review of your business performance is vital for making informed decisions about your business's future. This involves analyzing your financial results and comparing them to previous years.

Year-over-Year Comparison Techniques

Compare your current year's financial results with previous years to identify trends, opportunities, and challenges. This analysis will help you refine your business strategy and make data-driven decisions.

By following this small business finance checklist, you can ensure that your business is financially healthy and well-prepared for the upcoming year. For professional assistance with your bookkeeping and financial management, consider reaching out to Precision Accounting Intl.

Common Bookkeeping Mistakes Small Businesses Make (and How to Avoid Them)

Effective bookkeeping is crucial for small businesses, yet many fall prey to avoidable errors. Proper bookkeeping practices not only ensure compliance with financial regulations but also provide valuable insights into a company's financial health. By understanding common bookkeeping mistakes, small businesses can take proactive steps to avoid them.

Mixing Personal and Business Finances

One of the most significant bookkeeping mistakes is mixing personal and business finances. This can lead to inaccurate financial records, making it challenging to track business expenses and identify areas for cost reduction. To avoid this, it's essential to set up dedicated business accounts.

Setting Up Dedicated Business Accounts

Opening separate bank accounts for your business helps in maintaining a clear distinction between personal and business transactions. This not only simplifies bookkeeping but also enhances financial organization. Consider the following benefits:

- Easier financial record-keeping

- Improved accuracy in financial reporting

- Better control over business expenses

Neglecting Regular Reconciliation

Neglecting regular reconciliation is another common mistake that can result in discrepancies and errors. Regular reconciliation helps in identifying and correcting mistakes in financial records.

Creating a Reconciliation Schedule

To avoid the pitfalls of neglecting reconciliation, create a schedule to regularly review and reconcile your financial statements. This practice ensures that your financial records remain accurate and up-to-date.

| Reconciliation Frequency | Benefits |

| Monthly | Timely detection of errors, improved financial accuracy |

| Quarterly | Enhanced financial planning, better budgeting |

Improper Expense Categorization

Improper expense categorization can make it difficult to track business expenses and identify areas for cost reduction. Developing a consistent categorization system is crucial.

Developing a Consistent Categorization System

Establish a clear and consistent system for categorizing expenses. This will enable you to accurately track and analyze your business expenses, making informed decisions easier.

"Accurate bookkeeping is the backbone of any successful business. By avoiding common bookkeeping mistakes, small businesses can ensure financial stability and growth."

By being aware of these common bookkeeping mistakes and taking steps to avoid them, small businesses can maintain accurate financial records, make informed decisions, and drive growth. For expert guidance on bookkeeping and accounting, consider consulting professionals like Precision Accounting Intl.

How Precision Accounting Intl Can Transform Your Small Business Bookkeeping

At Precision Accounting Intl, we understand the importance of accurate bookkeeping for small business success. Our team is dedicated to providing top-notch bookkeeping services that cater to the unique needs of your business.

Our Comprehensive Bookkeeping Services

We offer a wide range of bookkeeping services designed to keep your financial records accurate and up-to-date. Our services include:

- Financial statement preparation

- Accounts payable and receivable management

- Payroll processing

- Budgeting and financial planning

Customized Solutions for Your Industry

Our team understands that different industries have different needs. That's why we offer customized bookkeeping solutions tailored to your specific industry, ensuring compliance with relevant regulations and standards.

Benefits of Working with Professional Accountants

By working with our professional accountants, you can benefit from expert knowledge and personalized service. Our team stays updated with the latest accounting standards and best practices, ensuring your business receives the best possible support.

Time and Cost Savings

Outsourcing your bookkeeping to us can result in significant time and cost savings. By letting us handle the financial tasks, you can focus on what you do best - running your business.

Client Success Stories

Our clients have achieved remarkable results with our bookkeeping services. As one of our satisfied clients noted, "

Precision Accounting Intl has been instrumental in helping us manage our finances effectively. Their expertise has been invaluable.

"

Real Results from Real Small Businesses

We've helped numerous small businesses like yours achieve financial clarity and success. Our tailored approach ensures that each client receives the support they need to grow and thrive.

Conclusion: Taking Control of Your Small Business Finances

Maintaining accurate financial records is crucial for small business success. By following the small business bookkeeping checklist outlined in this article, you can ensure tax compliance, make informed decisions, and support business growth. Effective financial record keeping for small businesses enables you to track your progress, identify areas for improvement, and drive your business forward.

At Precision Accounting Intl, we are committed to helping you achieve your financial goals. Our team of professional accountants provides comprehensive bookkeeping services, guidance, and support to help you take control of your finances. By working with us, you can ensure that your financial records are accurate, up-to-date, and compliant with regulatory requirements.

Take the first step towards financial clarity and success. Reach out to Precision Accounting Intl today to learn more about our services and how we can help you drive your business forward.

Partnering with experienced accounting firms in NJ can provide the support you need to navigate complex bookkeeping and compliance tasks with confidence.

FAQ

What is the importance of bookkeeping for small businesses?

Bookkeeping is crucial for small businesses as it provides a clear picture of their financial situation, enabling them to make informed decisions, ensures tax compliance, and supports business growth.

What are the benefits of using cloud-based bookkeeping software?

Cloud-based bookkeeping software offers greater flexibility and scalability, allowing small businesses to access their financial records from anywhere and at any time.

How often should I review my accounts receivable?

It's recommended to review your accounts receivable on a weekly basis to identify any outstanding invoices and follow up with customers.

What are the common bookkeeping mistakes that small businesses make?

Common bookkeeping mistakes include mixing personal and business finances, neglecting regular reconciliation, and improper expense categorization.

How can Precision Accounting Intl help with my small business bookkeeping?

Precision Accounting Intl offers comprehensive bookkeeping services tailored to your industry, providing customized solutions, time and cost savings, and valuable insights to support your business growth.

What is the importance of reconciling my bank and credit card statements?

Reconciling your bank and credit card statements monthly will help you identify any discrepancies and ensure that your financial records are accurate.

How can I ensure tax compliance for my small business?

To ensure tax compliance, you should estimate your tax liability, make quarterly tax payments, and organize your tax documentation to meet the required deadlines.

What are the benefits of working with professional accountants?

Working with professional accountants can provide time and cost savings, valuable insights, and expert guidance to support your business growth and financial management.

Related Articles

Services provided for you

Bookkeeping Services in Clifton, NJ

We serve a range of industries and customers, in an organized, friendly, and reliable way.

Business Tax Services

We are in a position to identify tax planning shots that reduce both your current and future tax liabilities.

Individual Tax Services

We gauge our worth by the personal and business successes of our clients and industries.

Payroll Services

For small and large corporations, payroll systems, highly qualified payroll experts support our services. Our primary objective is to provide customized services and highly favorable pricing for you.

Non-Profit Organization Services

Precision Accounting Intl can assist you set up and maintain your non-profit organizations nontaxable standing by handling all the authority reportage for you.

Part-Time CFO Services

If you"re ready enough to be in this role. Our Part-Time CFO Service Package provides you with a knowledgeable financial manager who will work with you to help guide the progress of your business.

.webp)