When you need a tax preparer in Edison, NJ who combines deep expertise with personalized service, Precision Accounting Intl delivers unmatched value. We are a full‑service CPA firm specializing in tax preparation, planning, compliance, and representation for individuals and businesses throughout Edison and the surrounding New Jersey communities.

We are a CPA firm in New Jersey Our team of licensed CPAs, IRS enrolled agents, and tax specialists leverages decades of professional experience to ensure your taxes are filed accurately, strategically, and on time, while maximizing refunds and minimizing liabilities.

Whether you are an individual taxpayer, a self‑employed professional, or a business owner managing complex filings, Precision Accounting Intl is your trusted partner for comprehensive tax solutions grounded in local insight and financial expertise.

Why Precision Accounting Intl is the Right Choice for Edison, NJ

Tax regulations at the federal and state level are constantly evolving, making it increasingly challenging to stay compliant and optimize your financial position. At Precision Accounting Intl, we take the complexity out of tax preparation by delivering services that go far beyond simply filing returns. Our approach ensures your financial outcomes are strengthened through intelligent planning, careful execution, and consistent compliance with IRS and New Jersey tax laws.

Working with our tax preparers means you will benefit from:

- Advanced tax strategies designed to lower your tax liability and maximize your refund

- Expert handling of complex tax codes for both federal and NJ income taxes

- Year‑round support, including quarterly projections, estimated taxes, and IRS correspondence

- Local focus on Edison residents and businesses, with insights into regional tax requirements and incentives

You may need a tax preparer in New Jersey

Our team’s combined experience and dedication to client success make us a top choice for anyone seeking elite tax preparation services in Edison, NJ.

Tax Preparer Credentials Explained

Choosing the right tax professional is critical. At Precision Accounting Intl, we offer credentialed expertise across the most recognized and trusted tax professional designations:

Certified Public Accountants (CPAs)

CPAs hold the highest professional license in accounting and taxation. They provide full tax planning, preparation, audit support, and represent you before the IRS or NJ Division of Taxation in matters like audits, disputes, and penalty resolution.

Enrolled Agents (EAs)

EAs are federally authorized tax professionals specializing in taxation. With unlimited representation rights before the IRS, our EAs are essential for complex tax matters and negotiating on your behalf during audits or compliance reviews.

PTIN Registered Preparers

Our IRS qualified preparers hold PTIN (Preparer Tax Identification Numbers), ensuring your returns are prepared by trained professionals who understand IRS procedures and reporting requirements.

Together, these credentials give you a powerful combination of technical ability, compliance authority, and strategic insight at every stage of the tax lifecycle.

Comprehensive Services Offered in Edison, NJ

At Precision Accounting Intl, our tax and accounting services are designed to address every possible tax need — from basic preparation to advanced tax strategy and financial planning.

Individual Tax Services

Certified tax preparers help Edison residents with:

- Preparation and filing of Federal and New Jersey state tax returns

- Tax planning strategies that capture every eligible deduction and credit

- Personalized advice for life changes (new home, career change, family additions)

- Retirement income tax planning and capital gains optimization

- Assistance with ITIN applications and unique tax identifiers

We tailor our approach to your personal financial profile, ensuring you take advantage of every available opportunity to improve your tax position.

Know more about:

- New Jersey state income tax.

- Check Our individual tax services

- Form 1040 instructions.

Business Tax Services

Growing and managing a business in Edison demands attention to tax detail. Our firm supports:

- Tax filing for corporations (C Corp, S Corp), LLCs, partnerships, and sole proprietors

- Preparation of quarterly estimated tax payments and projections

- Strategic tax planning for business growth, payroll taxes, and entity optimization

- Comprehensive compliance with federal and NJ business filing requirements

- Representation and resolution for IRS and state tax notices, audits, or penalties

We integrate your tax planning with your business goals, helping you streamline finances and reduce tax burdens effectively.

Know more about: our tax preparation for businesses services

Specialized Tax & Compliance Solutions

Precision Accounting Intl also offers:

- IRS and NJ state tax audit representation

- Back tax filing and penalty abatement assistance

- Multi‑state and cross‑jurisdiction tax coordination

- FBAR and international tax compliance for clients with foreign accounts or income

- Estate and trust taxation, including fiduciary tax computations

Our tax professionals stay ahead of regulatory changes so you don’t have to — saving you stress, time, and money.

How to Choose the Best Tax Preparer in Edison NJ

Selecting a tax preparer is about trust, expertise, and local relevance — not just price. Here’s how Precision Accounting Intl stands apart:

- Proven professional credentials: Licensed CPAs and EAs with real IRS representation authority.

- Comprehensive service range: From simple filing to advanced planning, we cover every tax scenario.

- Transparent pricing and upfront proposals: You will never face hidden fees or surprise charges.

- Edison local knowledge: Our preparers understand NJ income tax specifics that matter to local residents and businesses.

- Client testimonials and high retention: Local clients repeatedly choose us for year‑over‑year tax support and financial guidance.

We encourage prospective clients to ask about our process, deliverables, and strategic planning approach during your free initial consultation.

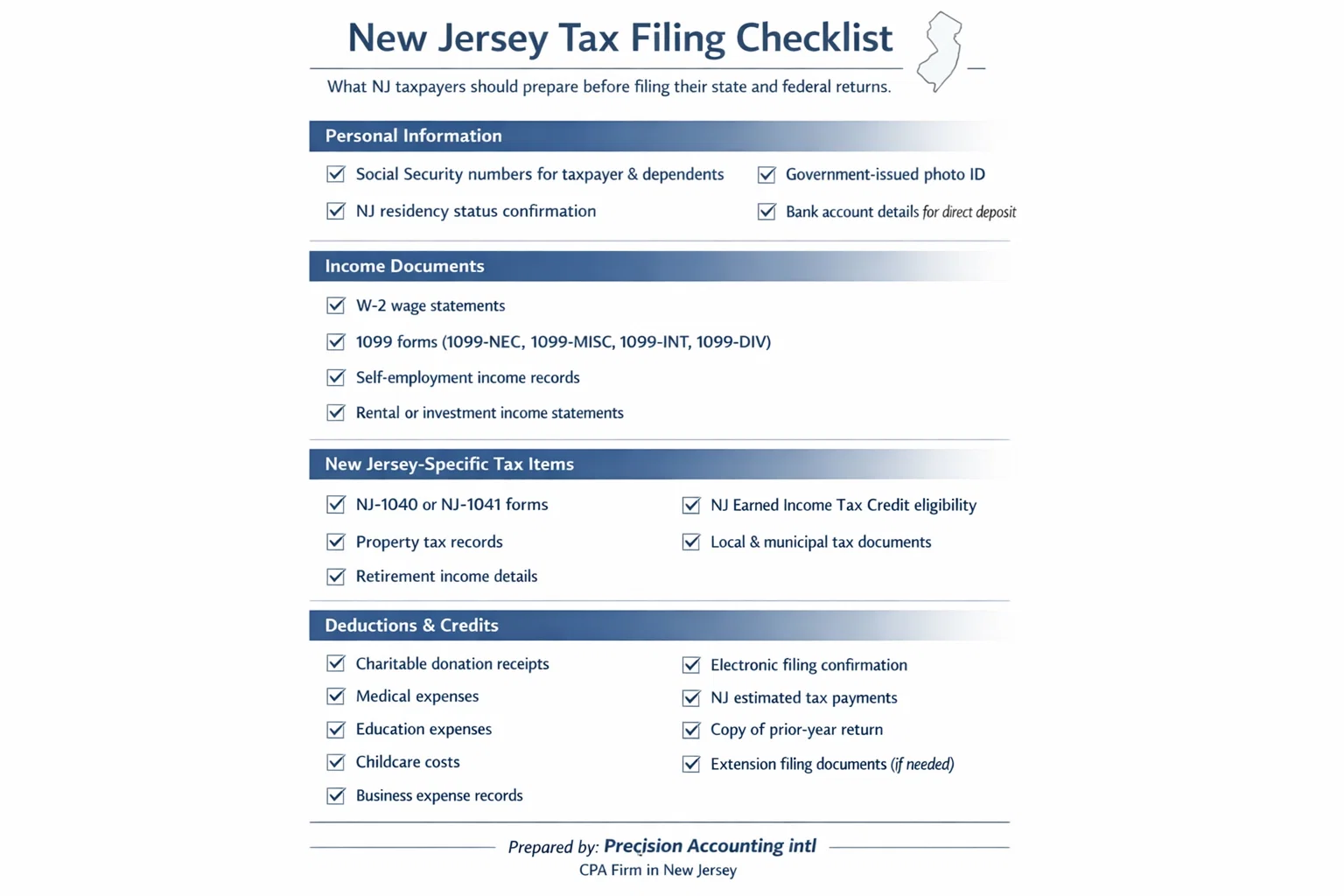

What to Bring: Edison Tax Preparation Checklist

To ensure a smooth and complete tax preparation process, bring the following when you meet with our team:

- Income documentation — W-2, 1099s, K‑1s, investment statements

- Expense records — receipts for deductions, health and education costs

- Business financials — profit/loss statements, payroll documents, bookkeeping records

- Previous tax returns — federal and NJ state filings

- Identification — Social Security numbers, ITIN documentation

This preparation allows our tax preparers to accurately assess your situation and deliver optimal results.

Know more about: Tax Prep Checklist for Individuals, Business, and Expats

Contact Precision Accounting Intl Today

When precision, professionalism, and local expertise matter, choose Precision Accounting Intl as your tax preparer in Edison, NJ. Our team is ready to help you navigate taxes with confidence — from preparation to planning, compliance, and IRS representation.

Call: (973) 956-1040

Office: 1035 US Highway 46 East STE B-101, Clifton, NJ 07013

Schedule Your Free Consultation Today.

Frequently Asked Questions (FAQs)

1. Do I need a tax preparer in Edison NJ?

Yes. A licensed CPA or Enrolled Agent ensures your federal and NJ tax returns are accurate, maximizes refunds, and provides audit protection.

2. What services does Precision Accounting Intl offer?

We provide individual and business tax preparation, NJ and federal filings, IRS audit representation, tax planning, FBAR reporting, and estate and trust taxation.

3. How much does a tax preparer in Edison NJ cost?

Fees range by complexity. Transparent quotes are provided upfront.

4. What documents should I bring for tax preparation?

Bring W-2s, 1099s, K-1s, previous year returns, business financials, investment statements, receipts for deductions, and Social Security/ITIN documents.

5. How early should I meet a tax preparer?

Schedule your appointment before tax season starts. Early planning ensures deductions, credits, and estimated taxes are accurately managed.

6. Can Precision Accounting Intl represent me in an IRS audit?

Yes. Our CPAs and EAs provide full IRS and NJ audit representation, handling correspondence, negotiations, and compliance issues on your behalf.

7. Why choose Precision Accounting Intl over other tax preparers in Edison NJ?

We combine licensed expertise, local NJ knowledge, transparent pricing, and personalized service to maximize refunds and reduce tax liabilities for individuals and businesses.