Every January, millions of employees in New Jersey receive a familiar form in the mail or digitally — the W-2 form. At first glance, it might just look like a jumble of numbers and boxes. But for anyone filing taxes, the W-2 is one of the most important documents you’ll use all year.

Here’s the problem: many taxpayers don’t fully understand what their W-2 is for, how to use it correctly, or what mistakes to avoid. And that confusion often leads to incorrect filings, delayed refunds, and even IRS penalties.

In this article, we’ll break down what a W-2 is for, why it matters in NJ, common mistakes people make, and how Precision Accounting Intl helps clients with tax settlement services when W-2-related problems spiral into bigger tax issues.

What Is a W-2 Form?

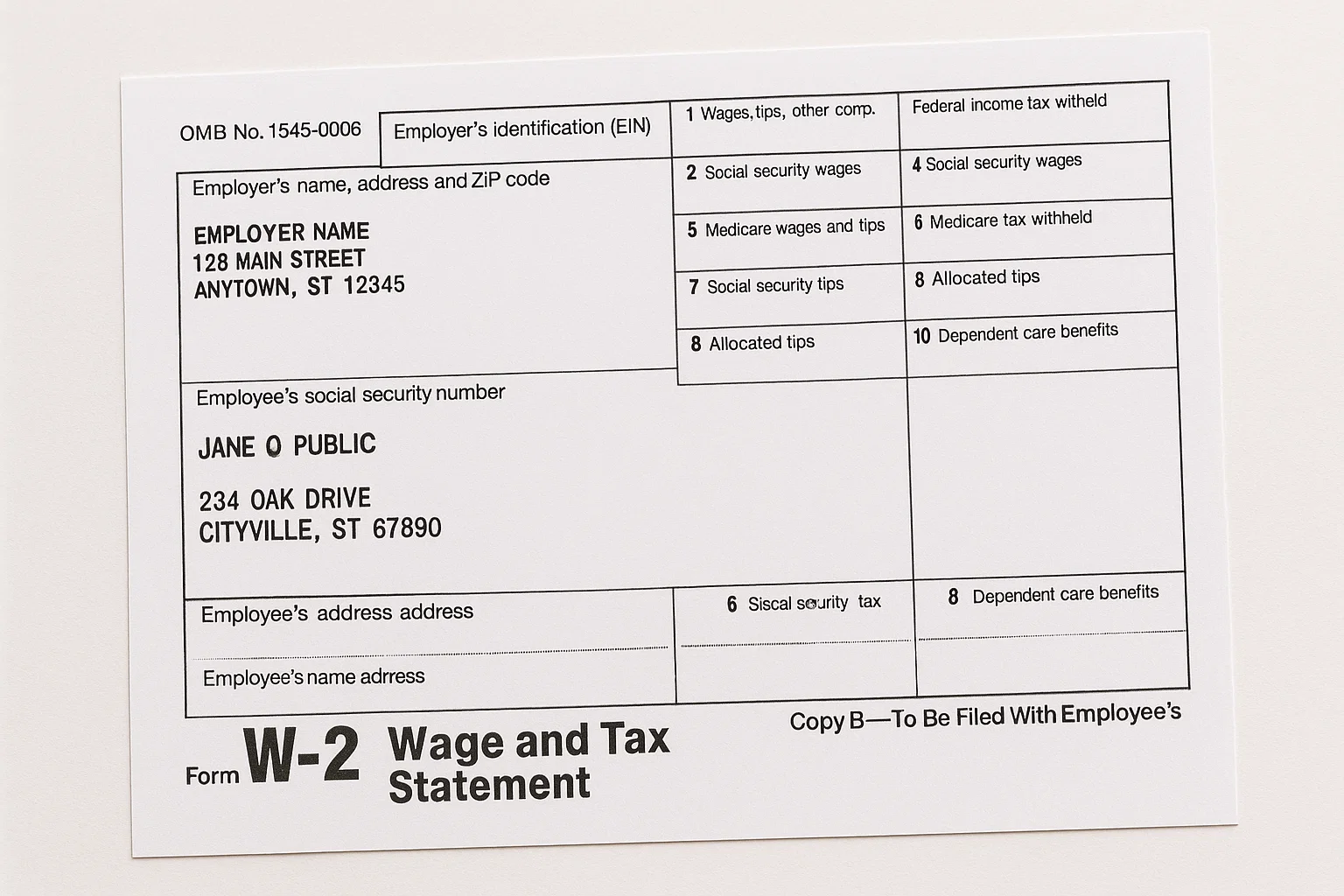

The W-2 form, officially called the Wage and Tax Statement, is issued by employers to employees at the end of each tax year. It reports:

- Total wages earned in the year

- Federal income tax withheld

- State and local taxes withheld (including New Jersey)

- Social Security and Medicare contributions

- Employer and employee benefit contributions (retirement plans, health insurance, etc.)

Every employer is required by law to provide W-2s by January 31st. This ensures employees have enough time to file accurate tax returns.

Quick Tip: Independent contractors don’t get a W-2 — they receive a W-9 form or a 1099 instead.

Why Is a W-2 Important in NJ?

For New Jersey residents, the W-2 isn’t just a federal requirement — it’s essential for state tax filings too. NJ’s tax system requires you to file both federal (IRS) and state (NJ Division of Taxation) returns.

Key Reasons Your W-2 Matters:

- Accuracy in Filing Taxes

Your W-2 ensures the IRS and the NJ Division of Taxation know exactly how much income you earned and what you already paid in taxes. - Eligibility for Tax Credits and Deductions

Many credits, like the NJ property tax relief credit (Who is eligible?), depend on income thresholds. Your W-2 is the proof. - Avoiding IRS Red Flags

Filing without a W-2, or entering incorrect amounts, can trigger audits and tax collection actions. And yes, NJ can even take money from your bank account if you don’t pay.

Breaking Down the W-2: Box by Box

Understanding each section of your W-2 can prevent costly mistakes. Here’s a simplified breakdown:

| Box | What It Reports | Why It Matters |

| Box 1 | Wages, tips, other compensation | Used for federal tax filing |

| Box 2 | Federal income tax withheld | Impacts refund or tax bill |

| Box 3-4 | Social Security wages & tax withheld | Ensures retirement credits |

| Box 5-6 | Medicare wages & tax withheld | Impacts Medicare eligibility |

| Box 16 | State wages (NJ) | Used for NJ-1040 filing (see NJ-1040 instructions) |

| Box 17 | State income tax withheld | Confirms NJ state tax compliance |

| Box 20 | Local taxes (if applicable) | Clifton, Paterson, and other NJ cities may apply local taxes |

W-2 vs. Other Tax Forms: What’s the Difference?

Many taxpayers confuse W-2s with other forms. Here’s a quick comparison:

- W-2 – For employees, reports wages and withholdings

- 1099-NEC – For independent contractors/freelancers

- W-9 – For contractors to provide taxpayer information (learn more here)

- NJ Property Tax Relief Forms – For homeowners seeking credits like the Anchor tax relief

This distinction is critical — filing the wrong form can cause refund delays or rejection of your NJ return.

Common Mistakes People Make with W-2s in NJ

Even though W-2s look straightforward, small errors can create big tax headaches.

Top W-2 Mistakes in NJ:

- Filing before receiving all W-2s (if you changed jobs)

- Entering numbers incorrectly into tax software

- Ignoring state wage differences in Box 16

- Not checking for errors in Social Security/Medicare contributions

- Misplacing your W-2 — which can delay your filing and refund

If you lose your W-2, you can request a copy from your employer or file with an IRS substitute form.

What If My W-2 Is Wrong?

Mistakes on W-2s happen — employers may misreport wages or withholdings.

Steps to Fix It:

- Contact our employer for a corrected W-2 (Form W-2c).

- If unresolved, file your return with the information you have and attach proof.

- Work with an accountant to avoid IRS penalties.

In severe cases, errors can cause back taxes. And remember — NJ can collect back taxes for years.

How W-2s Impact Your NJ Tax Return

Your W-2 directly ties into:

- Filing your federal 1040

- Filing your NJ-1040

- Claiming NJ-specific credits like:

Failure to report W-2 wages correctly could result in penalties, such as the NJ penalty for late payment of taxes.

How Precision Accounting Intl Helps with W-2 and Tax Settlement Issues

At Precision Accounting Intl, we know that W-2 issues often lead to larger problems — unfiled returns, IRS notices, or state tax liens. Our NJ tax settlement services help clients:

- Correct errors on W-2s and refile tax returns

- Negotiate with the IRS or NJ Division of Taxation

- Set up manageable tax payment plans

- Avoid garnishments, liens, or bank account seizures

If you’re struggling with W-2 errors, unfiled taxes, or tax debt, our team can resolve it before penalties escalate.

📞 Call Precision Accounting Intl today to schedule your consultation on tax settlement services in NJ.

Conclusion: Don’t Let a W-2 Mistake Derail Your Taxes

Your W-2 is more than just a piece of paper — it’s the foundation of your entire tax filing process. Whether you’re filing for a refund, applying for NJ property tax relief, or avoiding costly penalties, understanding your W-2 ensures accuracy and peace of mind.

If you’ve hit a snag with your W-2 or face tax debt in NJ, don’t wait. Contact Precision Accounting Intl for professional tax settlement services that help you take control of your financial future.

FAQs About W-2s in New Jersey

1. When do I get my W-2?

By January 31st each year.

2. What if I work multiple jobs in NJ?

You’ll receive a W-2 from each employer and must include them all.

3. Can my refund be delayed without a W-2?

Yes — missing W-2s can prevent your return from processing.

4. What if I owe taxes after filing my W-2?

Options include payment plans or working with a tax relief service in NJ.

5. Can a W-2 affect my NJ property tax relief eligibility?

Yes, income reported on your W-2 may determine if you qualify for programs like the NJ property tax relief fund.

Related Articles

Services provided for you

Bookkeeping Services in Clifton, NJ

We serve a range of industries and customers, in an organized, friendly, and reliable way.

Business Tax Services

We are in a position to identify tax planning shots that reduce both your current and future tax liabilities.

Individual Tax Services

We gauge our worth by the personal and business successes of our clients and industries.

Payroll Services

For small and large corporations, payroll systems, highly qualified payroll experts support our services. Our primary objective is to provide customized services and highly favorable pricing for you.

Non-Profit Organization Services

Precision Accounting Intl can assist you set up and maintain your non-profit organizations nontaxable standing by handling all the authority reportage for you.

Part-Time CFO Services

If you"re ready enough to be in this role. Our Part-Time CFO Service Package provides you with a knowledgeable financial manager who will work with you to help guide the progress of your business.