Finding a reliable, experienced tax preparer in NJ is one of the most important financial decisions you can make each year. New Jersey tax laws are complex, filing requirements change frequently, and even small errors can trigger penalties, audits, or missed deductions that cost you thousands of dollars.

At Precision Accounting Intl, we are a New Jersey-based CPA firm with years of hands-on experience preparing NJ state and federal tax returns for individuals, families, self-employed professionals, and businesses across the state.

Our role goes far beyond data entry. We provide strategic tax preparation, compliance guidance, and proactive tax planning designed to protect your income and maximize your refund while keeping you fully compliant with IRS and New Jersey Division of Taxation rules.

If you are searching for the best tax preparer in NJ, or need a tax preparer in NJ online who delivers accuracy, transparency, and professional accountability, you are in the right place.

Understanding Tax Preparation in New Jersey vs DIY Filing

Many taxpayers assume that online tax software is sufficient. In New Jersey, that assumption often leads to costly mistakes.

New Jersey has its own tax structure, credits, residency rules, and filing requirements that differ significantly from federal returns.

DIY software frequently overlooks state-specific deductions, misclassifies income, or applies incorrect residency status, especially for remote workers, multi-state filers, and small business owners.

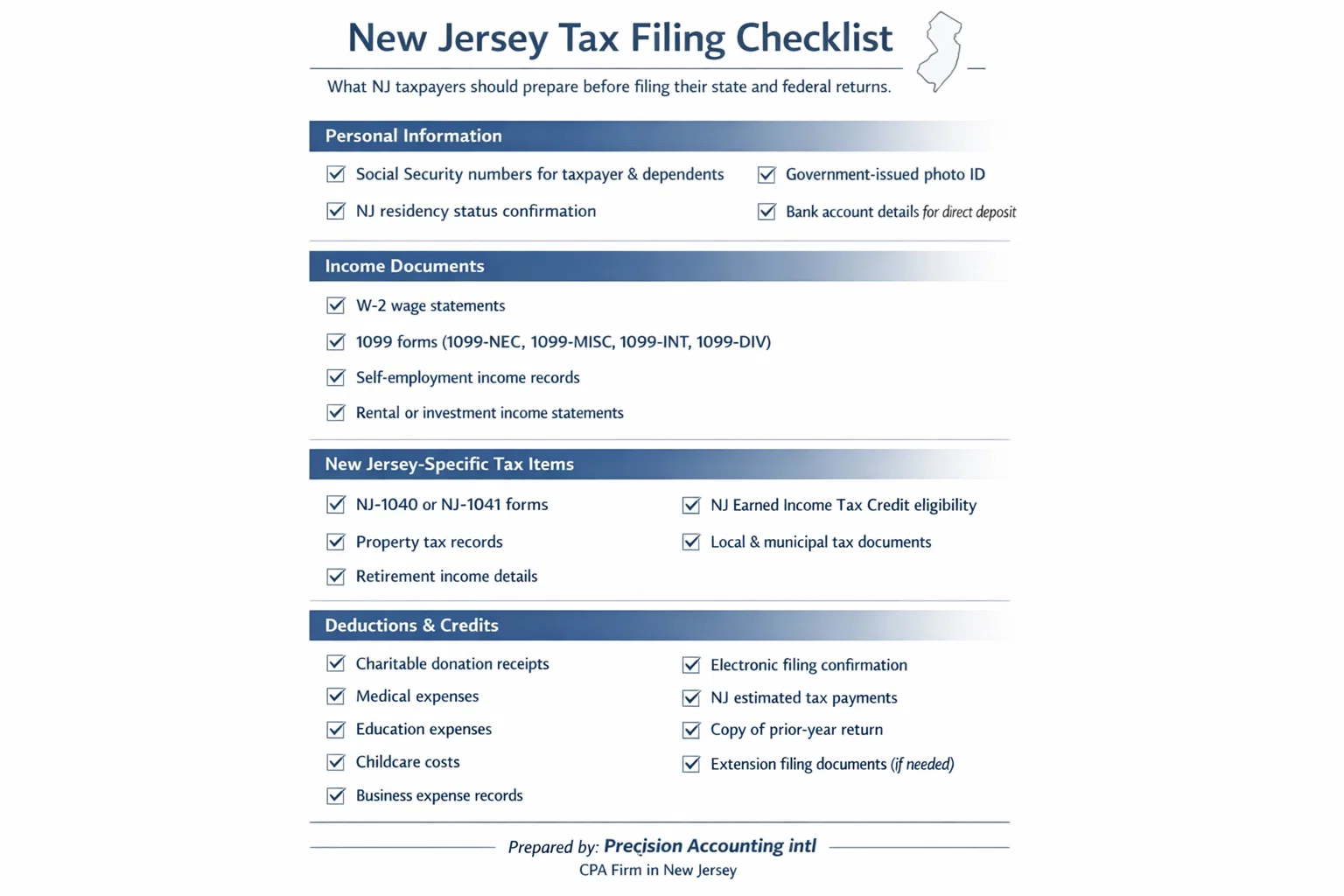

A professional NJ tax preparer ensures:

- Proper alignment between your federal return and NJ-1040 or NJ-1041 filings

- Accurate reporting of wages, self-employment income, rental income, and investments

- Compliance with NJ electronic filing mandates

- Protection against errors that can trigger audits or delayed refunds

At Precision Accounting Intl, we review your entire financial picture, not just last year’s numbers. That is the difference between filing a return and preparing it correctly.

Tax Preparer Credentials Explained: CPA, Enrolled Agent, and PTIN

Not all tax preparers are equally qualified. In New Jersey, anyone paid to prepare taxes must hold a Preparer Tax Identification Number (PTIN), but credentials beyond that matter significantly.

At Precision Accounting Intl, your returns are handled by licensed CPAs, which provides a higher level of oversight, ethical responsibility, and technical expertise.

As a CPA firm in NJ, we are authorized to represent clients before the IRS and provide long-term tax planning, not just annual filing services.

NJ E-File Mandates and State Filing Requirements

New Jersey requires most paid tax preparers to electronically file tax returns unless a valid exemption applies. Filing incorrectly or missing state-specific forms can result in processing delays, penalties, or rejection of your return.

Our firm stays current with:

- NJ Division of Taxation e-file mandates

- State residency and part-year residency rules

- Filing thresholds for individuals and businesses

- Federal and NJ filing deadline coordination

When you work with Precision Accounting Intl, your return is prepared and submitted in full compliance with both IRS and New Jersey requirements.

What Our NJ Tax Preparation Services Include

We provide comprehensive tax preparation services tailored to your situation, whether you are filing as an individual or managing a growing business.

Individual Tax Preparation

- NJ and federal income tax returns

- Self-employed and 1099 income reporting

- Rental property and investment income

- Credits and deductions optimization

Business Tax Preparation

- LLC, S-Corp, C-Corp, and partnership returns

- Payroll tax coordination

- Multi-state filing support

- Year-end tax planning strategies

Additional Tax Support

- IRS and NJ audit assistance

- Prior-year return corrections

- Tax planning and compliance consulting

Clients searching for a tax preparer NJ online benefit from secure document sharing, remote consultations, and electronic filing without sacrificing professional oversight.

Key New Jersey Tax Credits and Deductions Many Filers Miss

One of the most common reasons taxpayers overpay is missed state-specific tax benefits. Our CPA team identifies deductions and credits that generic software and inexperienced preparers often overlook.

These may include:

- New Jersey Earned Income Tax Credit considerations

- Retirement income exclusions

- Property tax deductions

- Self-employment expense optimization

- Business credits and depreciation strategies

We do not rely on shortcuts. Every return is reviewed with NJ-specific tax law in mind.

How to Choose the Best Tax Preparer in NJ

When comparing tax preparers, price alone should never be the deciding factor. A qualified tax preparer protects you long after the return is filed.

Use this checklist:

- Are they licensed CPAs

- Do they understand NJ-specific tax rules

- Will they stand behind the return if issues arise

- Do they explain pricing clearly and upfront

- Can they provide year-round support

Precision Accounting Intl meets every one of these standards.

Transparent Pricing and What to Expect

We believe professional tax preparation should be transparent and fair. Pricing depends on complexity, not hidden fees.

Factors that affect cost include:

- Type of return and income sources

- Business or self-employment activity

- Number of states involved

- Level of tax planning required

Before any work begins, we explain your pricing clearly so there are no surprises.

Serving Clients Across New Jersey

Precision Accounting Intl proudly serves clients throughout Clifton, Passaic County, Bergen County, Essex County, and across New Jersey. Whether you prefer in-person service or a fully online tax preparation experience, our team is equipped to support you.

Work With a Trusted NJ CPA Tax Preparer

Choosing the right tax preparer in NJ can protect your income, reduce stress, and give you confidence that your taxes are handled correctly.

At Precision Accounting Intl, we combine professional CPA expertise, NJ-specific tax knowledge, and a client-first approach to deliver results you can trust.

Schedule your consultation today and experience the difference of working with a New Jersey CPA firm committed to precision, compliance, and long-term financial success.

Frequently Asked Questions About NJ Tax Preparation

Do I need a CPA to prepare my NJ taxes?

Not legally, but a CPA provides deeper expertise, audit support, and long-term tax planning that non-credentialed preparers cannot offer.

Can I use an online tax preparer in NJ?

Yes, but working with a CPA firm that offers online services combines convenience with professional accountability.

What happens if my tax preparer makes a mistake?

With a CPA firm, accountability matters. We stand behind our work and assist with any notices or corrections.

When are NJ taxes due?

New Jersey tax returns typically follow the federal deadline, but extensions and estimated payments require proper planning.