Finding the right tax preparer in Jersey City, NJ is not about choosing the lowest price or the quickest option. It is about accuracy, compliance, strategic insight, and working with a firm that understands both federal tax law and New Jersey tax regulations, while also recognizing the real financial challenges of living and doing business in Hudson County. Precision Accounting Intl is a top-rated CPA firm in New Jersey providing professional tax preparation and accounting services to individuals and businesses throughout Jersey City and the surrounding areas.

We assist clients year-round with U.S. income tax return preparation, proactive tax planning, audit support, and resolution of unfiled or prior-year tax issues. Our firm serves a wide range of Jersey City residents, self-employed professionals, and business owners who want their taxes handled correctly, defensibly, and with long-term strategy in mind.

Whether you are filing a straightforward individual return or need comprehensive accounting and business support, including back taxes assistance, IRS audit representation, and payroll tax issue resolution, Precision Accounting Intl delivers meticulous work with a professional, client-focused approach.

What Is a Tax Preparer?

A tax preparer is a qualified professional authorized to prepare and file federal and state income tax returns on behalf of individuals and businesses. However, not all tax preparers have the same level of training, authority, or accountability. Understanding these differences is essential when deciding who should handle your tax filings.

You may need a tax preparer in New Jersey

Credentials and Representation Rights Explained

Tax preparers fall into different categories, each with varying qualifications and representation rights. A preparer holding only a PTIN is permitted to prepare tax returns but typically has limited training and no guaranteed authority to represent clients before the IRS. Enrolled Agents are federally licensed and authorized to represent taxpayers in audits, collections, and appeals before the Internal Revenue Service. Certified Public Accountants undergo extensive education, licensing, and continuing professional education, allowing them to provide advanced tax preparation, tax planning, and advisory services.

Precision Accounting Intl operates as a CPA firm, which means every return is prepared and reviewed under strict professional and regulatory standards. This added layer of oversight provides important protection, particularly for complex returns, business filings, or higher-risk tax situations.

Learn more about our individual tax services .

Why Precision Accounting Intl Is the Best Tax Preparer in Jersey City, NJ

Choosing the right tax preparer can significantly impact your refund, compliance status, and long-term financial health.

Unlike franchise tax offices that rely on seasonal staff and standardized filings, Precision Accounting Intl is a professional accounting firm available year-round to support your needs.

Clients trust us because we provide:

- CPA-led tax preparation with detailed accuracy reviews

- Extensive experience with federal, New Jersey, and local tax laws

- Strategic tax planning beyond basic filing

- Transparent pricing with no surprise fees

- Direct access to experienced professionals, not entry-level staff

We do more than enter numbers. We analyze your financial situation, identify overlooked deductions, evaluate tax-saving opportunities, and ensure your return is defensible if ever reviewed by tax authorities.

Read more: Form 1040 instructions.

Jersey City Tax Obligations

Jersey City taxpayers must comply with both federal and New Jersey tax requirements. Filing errors or overlooking state-specific rules can lead to penalties, delayed refunds, or audits. Precision Accounting Intl ensures your filings are accurate, compliant, and properly aligned across all required jurisdictions.

Federal vs New Jersey State Tax Filing Requirements

Most Jersey City residents are required to file both a federal income tax return and a New Jersey state return. New Jersey has its own rules governing income classification, deductions, exemptions, and credits, which differ from federal guidelines. Our firm ensures that both filings are consistent, accurate, and compliant with each governing authority.

New Jersey Property Tax Impact on Income Returns

While New Jersey does not allow full federal-style itemization, property taxes still play an important role in overall tax planning and household budgeting. Homeowners in Jersey City must understand how SALT limitations, deductions, and credits interact, and we help clients navigate these rules effectively.

Local Payroll and Commuter Income Considerations

Many Jersey City residents work in New York City or other states, creating multi-state income scenarios. We handle income allocation, credits for taxes paid to other states, and proper reporting to ensure income is not taxed twice.

What a Jersey City Tax Preparer Should Do for You

A professional tax preparer should offer more than basic filing services. Precision Accounting Intl provides a comprehensive range of services designed to support compliance, savings, and peace of mind.

Core Tax Preparation Services

We prepare individual, joint, business, and trust tax returns with thorough review and proper documentation. Each return is prepared in accordance with current tax law and best practices.

Audit Support and Representation

If you receive a notice from the IRS or the New Jersey Division of Taxation, our firm provides professional audit support and representation. Clients value having a CPA firm that stands behind their return and represents their interests.

Estimated Tax Payments and Quarterly Filings

Self-employed individuals and business owners are required to make estimated tax payments throughout the year. We calculate, schedule, and monitor quarterly payments to help clients avoid penalties and interest.

Tax Planning and Strategies

Tax planning is an ongoing process. We help clients reduce future tax liabilities through entity structuring, income timing, deduction optimization, and long-term planning strategies.

Important Tax Deductions and Credits for New Jersey Filers

Many Jersey City taxpayers miss valuable deductions and credits due to improper preparation or lack of guidance.

You may interested in our tax preparation for businesses services.

New Jersey Deductions Available to Taxpayers

We review standard and applicable itemized deductions, retirement contributions, healthcare expenses, and other opportunities to legally reduce your tax burden.

Earned Income Tax Credit

Eligible taxpayers may qualify for both federal and New Jersey Earned Income Tax Credits. Accurate calculation and documentation are critical to avoid delays or denials.

Child Tax Credit and Dependent Benefits

Families may qualify for child tax credits, dependent care credits, and education-related benefits. We ensure all eligible credits are claimed accurately and properly documented.

Small Business and Self-Employed Deductions

From home office expenses and vehicle use to equipment depreciation, we identify legitimate deductions that reduce taxable income while remaining audit-safe.

Choosing the Right Tax Preparer in Jersey City

Selecting a tax preparer should be a thoughtful decision, not a last-minute choice.

What to Ask Before Hiring

Ask about credentials, experience with New Jersey taxes, audit representation, and year-round availability. Precision Accounting Intl meets and exceeds these standards as a full-service CPA firm.

Pricing Expectations

We believe in transparent pricing. Fees are based on the complexity of your tax situation, with no hidden add-ons. Clients receive clarity before work begins.

Red Flags to Avoid

Be cautious of preparers who promise unrealistic refunds, lack proper credentials, or are unavailable outside of tax season.

Credentials Checklist

Our firm maintains active CPA licensure, professional liability insurance, and ongoing continuing education to remain current with tax law changes.

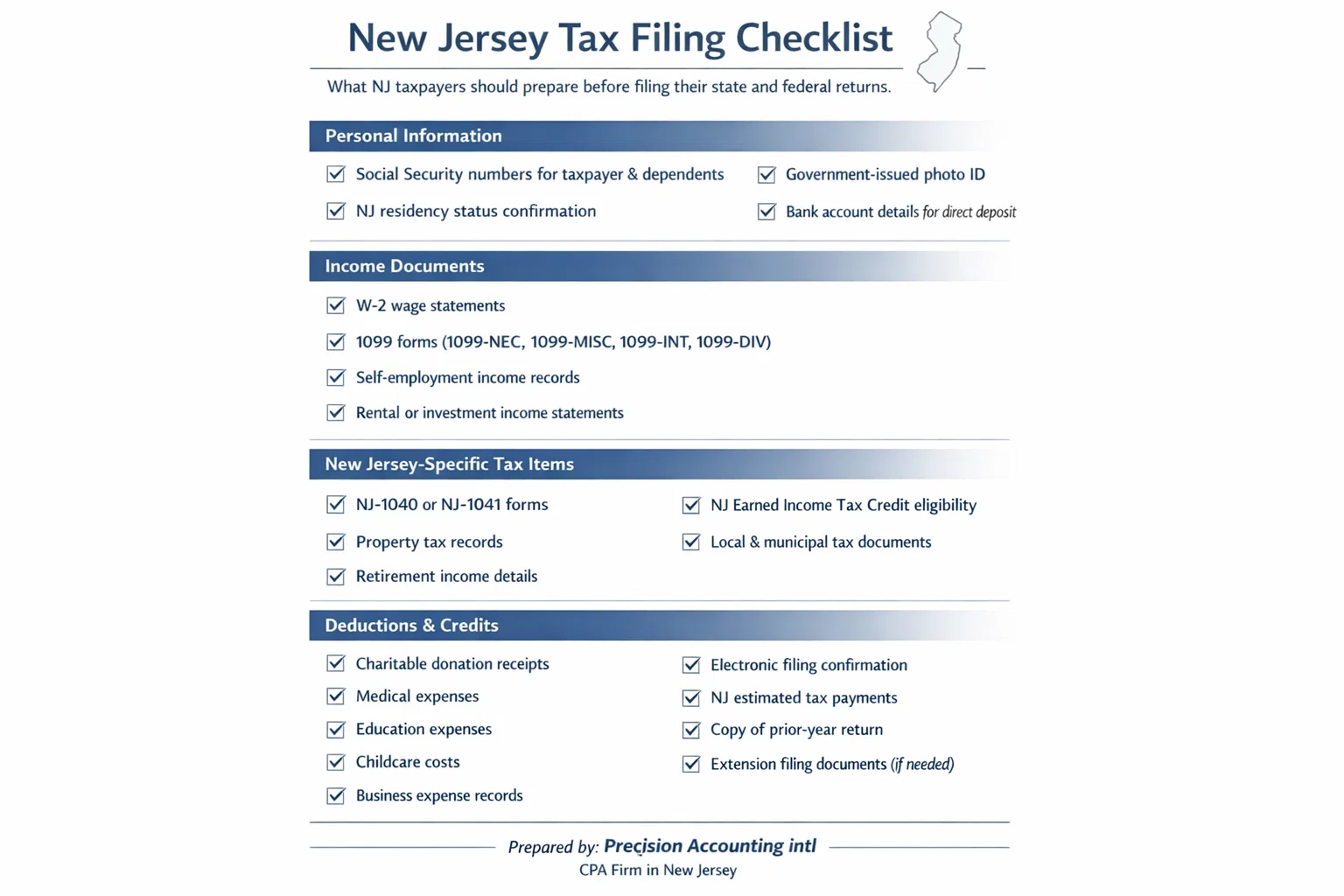

New Jersey Tax Filing Checklist

Preparation leads to accuracy and faster processing.

Documents to Bring

Clients should bring income statements, prior-year tax returns, identification, expense records, and any relevant business documentation.

Know more about: Who is eligible for the NJ property tax relief credit?

Deadlines and Electronic Filing Tips

We offer electronic filing for faster refunds and closely track deadlines to ensure timely submission.

Work With the Best Tax Preparer in Jersey City, NJ

If you are searching for a tax preparer in Jersey City NJ near me who offers accuracy, accountability, and real expertise, Precision Accounting Intl is here to help. We proudly serve Jersey City and the greater New York City metro area with professional tax preparation, planning, and representation services.

Call: (973) 956-1040

Office: 1035 US Highway 46 East STE B-101, Clifton, NJ 07013

Contact us today to schedule a free consultation and experience the confidence of working with a trusted CPA firm.

More Resources & Services

- small business preparer nj

- why outsource bookkeeping services in NJ

- are bookkeeping services taxable

- what is bookkeeping service

- types of bookkeeping services

- small business bookkeeping checklist

- How to do bookkeeping for NJ restaurants?

- what is quickbooks

- Quickbooks services in new Jersey

- best accounting firm in nj

- year end tax planning for businesses

- bookkeeping services in new Jersey

- tax relief service near nj

- retirement planning in NJ

- part-time cfo services

- business tax services

- indivedual tax services new jersey

- payroll near you in NJ

- online service bookkeeping usa

- tax accountant nj

- Amr Ibrahim, CPA

Frequently Asked Questions

How much does a tax preparer cost in Jersey City, NJ?

Tax preparation fees in Jersey City typically range from $250 to $1,200, depending on the complexity of your return. Simple W-2 filings cost less, while self-employed, multi-state, or business tax returns require additional analysis. At Precision Accounting Intl, we provide transparent, upfront pricing after a brief review so there are no surprises.

Is it better to use a CPA or a tax preparer?

A CPA offers a higher level of expertise, licensing, and accountability than a standard tax preparer. CPAs are trained in tax planning, IRS representation, and compliance for individuals and businesses. Precision Accounting Intl is a CPA firm, which means your return is prepared and reviewed with long-term tax strategy in mind, not just annual filing.

Can a tax preparer help with IRS problems?

Yes. A qualified CPA tax preparer can assist with IRS audits, tax notices, back taxes, penalties, and payment plans. Our Jersey City clients rely on us for IRS correspondence, audit defense, tax resolution, and proactive strategies to prevent future issues.

Do you offer tax preparation for small businesses in Jersey City?

Yes. We specialize in small business tax preparation for LLCs, S corporations, partnerships, and sole proprietors in Jersey City and Hudson County. Services include business tax returns, bookkeeping review, payroll tax filings, sales tax compliance, and year-round tax planning.

Are you a local tax preparer near me in Jersey City?

Yes. Precision Accounting Intl serves Jersey City residents and businesses, including Downtown Jersey City, Journal Square, Newport, Heights, and surrounding Hudson County areas. We combine local tax knowledge with CPA-level expertise and offer both in-office and remote tax services.

What documents do I need to bring to a tax preparer?

Common documents include W-2s, 1099s, prior-year tax returns, income and expense records, mortgage interest statements, property tax records, and identification. For business owners, we also review bookkeeping files, QuickBooks data, and payroll reports to ensure accuracy and compliance.

Can you prepare taxes for self-employed and freelancers?

Absolutely. We regularly prepare tax returns for freelancers, consultants, gig workers, and independent contractors in Jersey City. This includes Schedule C filings, quarterly estimated taxes, deduction optimization, and self-employment tax planning.

Do you help reduce taxes legally?

Yes. Tax reduction through legal planning is a core part of our CPA services. We analyze deductions, credits, entity structure, retirement contributions, and timing strategies to minimize tax liability while remaining fully compliant with IRS and New Jersey tax laws.

When should I hire a tax preparer instead of filing myself?

You should hire a tax preparer if you have self-employment income, multiple income sources, rental property, business ownership, IRS notices, or prior filing errors. Many Jersey City clients come to us after realizing DIY software missed deductions or created compliance risks.

Why choose Precision Accounting Intl as your Jersey City tax preparer?

We are a CPA firm with real-world experience serving New Jersey individuals and businesses. Our clients choose us for accuracy, proactive tax planning, transparent pricing, and personalized service. We do not rush returns, outsource blindly, or treat taxes as one-time transactions.