Filing taxes in New Jersey can feel overwhelming, especially if you’re unsure how much you’ll actually pay after deductions, credits, and exemptions. Whether you’re a single filer, married couple, retiree, or small business owner, understanding your NJ state income tax rate is essential to avoid surprises at tax time.

In this guide, you’ll find clear NJ income tax brackets for 2026, step-by-step calculation examples, common deductions, and NJ CPA firm tips. We’ll also explain how a NJ tax accountant from Precision Accounting Intl can help you save money and stay compliant.

By the end, you’ll know exactly:

- The current NJ income tax rates and brackets for filing in 2026

- How to calculate your marginal vs effective tax rate

- Credits, deductions, and exemptions available to reduce liability

- Residency rules and how they affect your NJ tax obligations

What Is the New Jersey State Income Tax?

New Jersey’s state income tax for the 2026 filing year is progressive, ranging from 1.4% to 10.75%, based on your income and filing status.

Progressive tax means you pay higher rates only on income within each bracket, not on your entire income.

The rate varies by filing status (single, married filing jointly, head of household, etc.) and is applied to taxable income after deductions and exemptions.

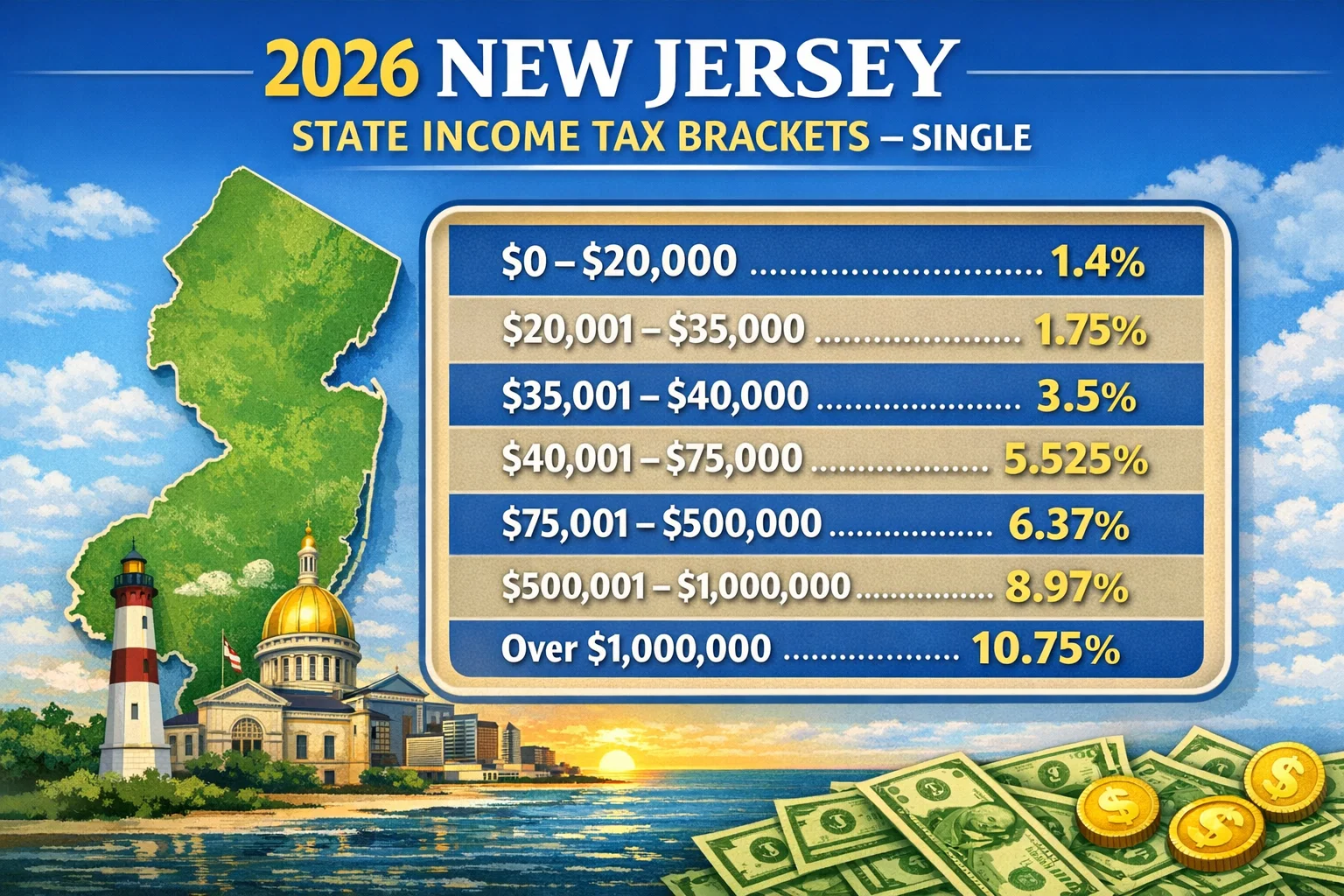

NJ Income Tax Brackets by Filing Status (2026)

Comparison Table: NJ Marginal Income Tax Rates

| Filing Status | Gross Income Range | Tax Rate (%) |

| Single | $0 – $20,000 | 1.4 |

| Single | $20,001 – $35,000 | 1.75 |

| Single | $35,001 – $40,000 | 3.5 |

| Single | $40,001 – $75,000 | 5.525 |

| Single | $75,001 – $500,000 | 6.37 |

| Single | $500,001 – $1,000,000 | 8.97 |

| Single | Over $1,000,000 | 10.75 |

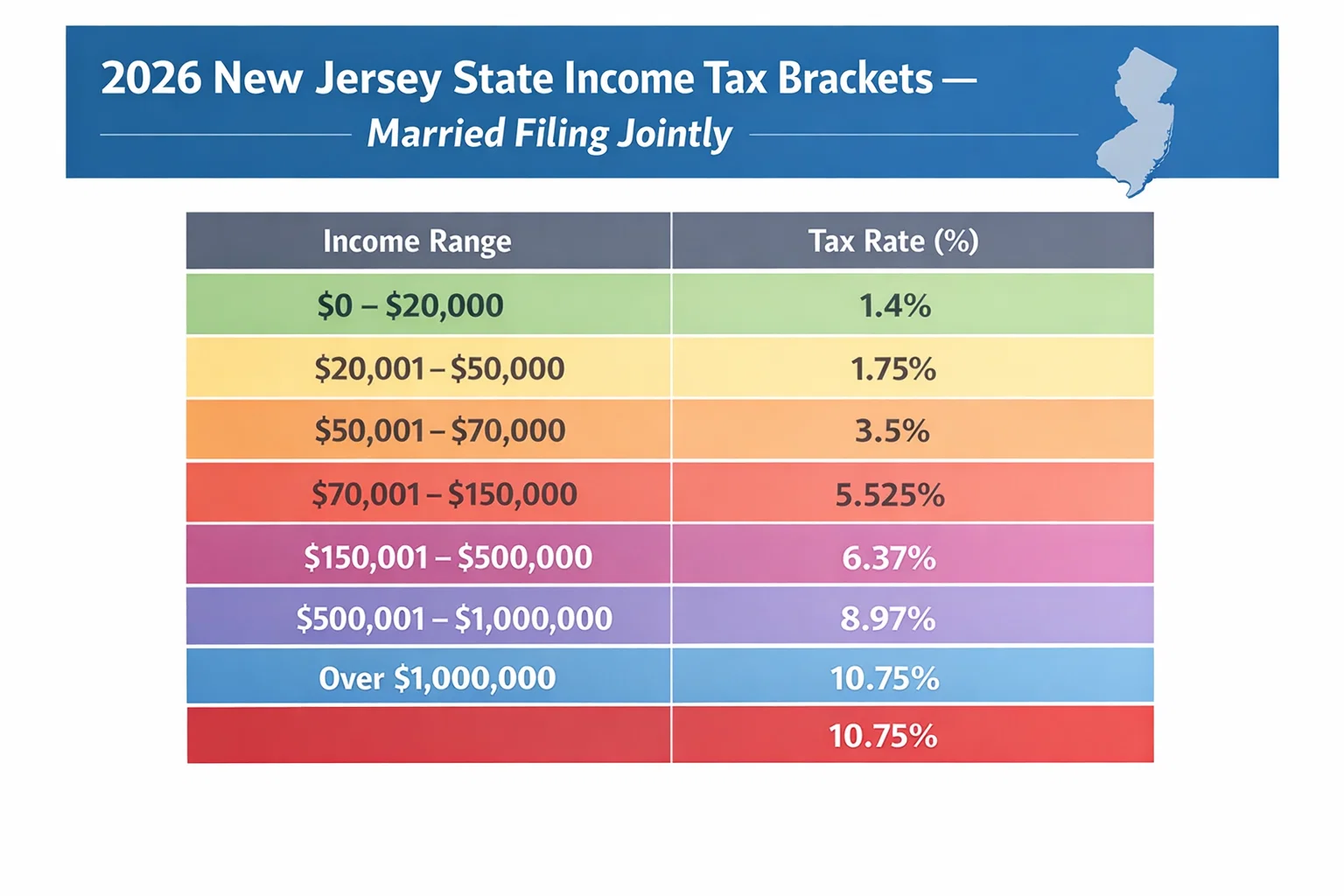

| Married Filing Jointly | $0 – $20,000 | 1.4 |

| Married Filing Jointly | $20,001 – $50,000 | 1.75 |

| Married Filing Jointly | $50,001 – $70,000 | 3.5 |

| Married Filing Jointly | $70,001 – $150,000 | 5.525 |

| Married Filing Jointly | $150,001 – $500,000 | 6.37 |

| Married Filing Jointly | $500,001 – $1,000,000 | 8.97 |

| Married Filing Jointly | Over $1,000,000 | 10.75 |

Tip: The rates above are for income earned in 2025, filed in 2026. Always check the NJ Division of Taxation website for official updates.

2026 new jersey state income tax brackets single filing jointly

2026 new jersey state income tax brackets married filing jointly

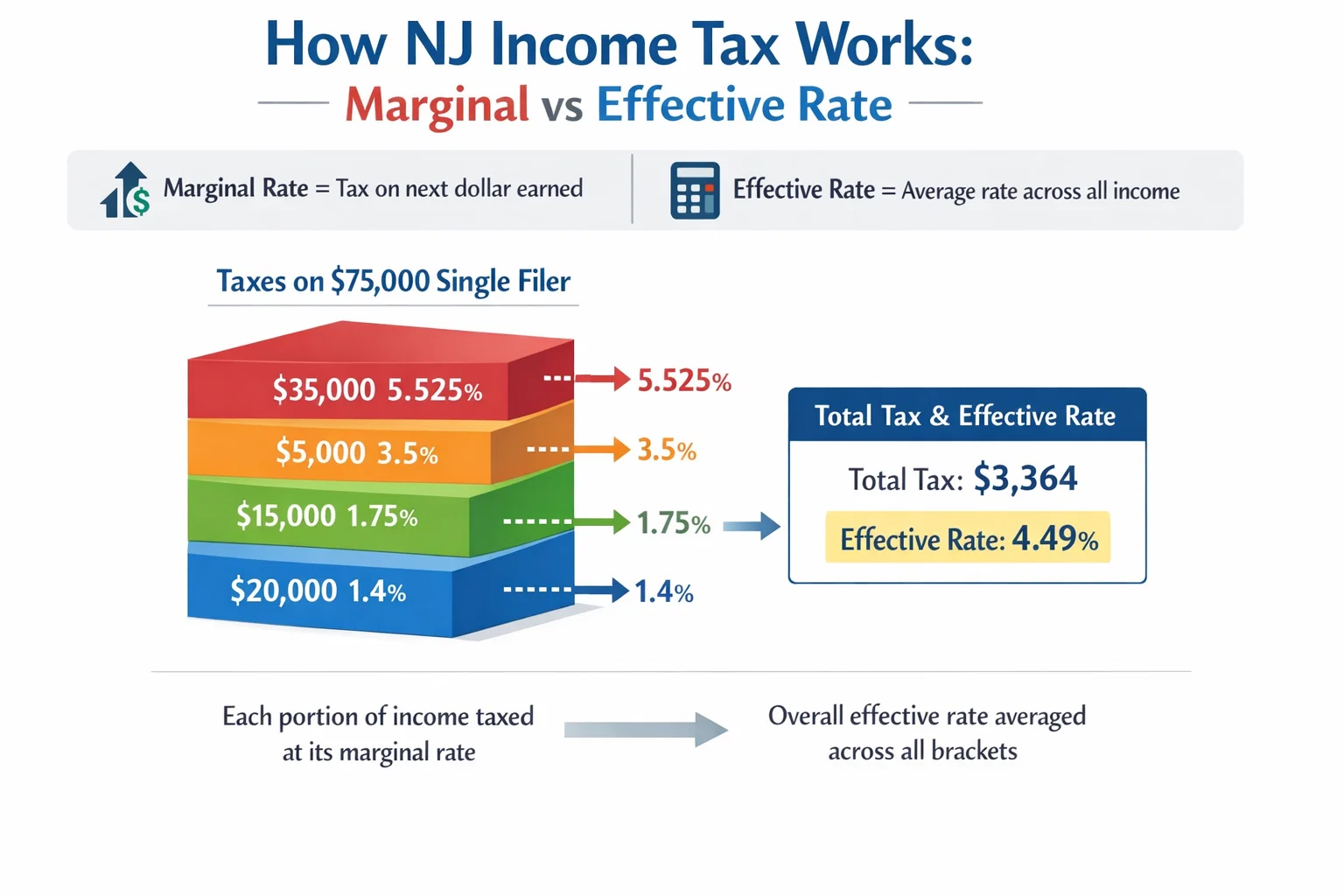

How NJ Income Tax Works: Marginal vs Effective Rate

Many taxpayers confuse marginal tax rate with effective tax rate:

- Marginal rate: the rate applied to your next dollar earned within a specific bracket

- Effective rate: your average tax rate across all taxable income

Example: A single filer earning $75,000 will pay different rates across brackets:

- Tax first $20,000 = 1.4%

- Next $15,000 = 1.75%

- Next $5,000 = 3.5%

- Remaining $35,000 = 5.525%

Total tax: $3,364

Effective rate: 4.49%

Residency Rules: Resident, Part-Year, Nonresident

NJ residency affects which income is taxed:

- Residents: Pay NJ tax on all income, regardless of source

- Part-year residents: Pay tax prorated for the portion of the year lived in NJ

- Nonresidents: Only NJ-sourced income is taxed (e.g., wages from a NJ employer)

Forms:

- NJ‑1040: Residents

- NJ‑1040NR: Nonresidents and part-year residents

How to Calculate Your NJ Income Tax (Step-by-Step Examples)

Example 1 — Single Filer, $50,000:

- First $20,000 = 1.4% = $280

- Next $15,000 = 1.75% = $262.50

- Next $5,000 = 3.5% = $175

- Remaining $10,000 = 5.525% = $552.50

Total NJ tax liability: $1,270

Effective rate: 2.54%

Example 2 — Married Filing Jointly, $120,000:

- First $20,000 = 1.4% = $280

- Next $30,000 = 1.75% = $525

- Next $20,000 = 3.5% = $700

- Remaining $50,000 = 5.525% = $2,762.50

Total NJ tax liability: $4,267.50

Effective rate: 3.55%

NJ Tax Credits, Deductions & Exemptions

Common NJ Tax Credits:

- Earned Income Tax Credit (EITC) — percentage of federal EITC

- Property Tax Deduction or Credit — homeowners and renters

- Child and Dependent Care Credit

- Retirement Income Exclusions — for seniors

Read more::

- Who is eligible for the NJ property tax relief credit?

- What is the $250 property tax deduction in NJ?

Tip: Properly claiming credits can reduce your effective tax rate significantly.

Retirement Income & NJ Taxes

Social Security: Not taxed in NJ

Pensions & IRAs: Exclusions may apply based on age and income limits

Read more::

When Should You File & What Forms You Need?

- Forms: NJ‑1040, NJ‑1040NR

- Deadline: April 15, 2026 (unless extended)

- Withholding & estimated taxes: Must be timely to avoid penalties

Read more::

- NJ‑1040 instructions

- Do I need to file NJ tax return?

- How long can NJ collect back taxes?

- How much is $250,000 after tax in NJ?

- Can the state of NJ take money from your bank account?

NJ vs Other States: Tax Burden Comparison

| State | Top Rate | Median Effective Rate | Notes |

| NJ | 10.75% | ~6.5% | High, but capped |

| NY | 10.9% | ~6.7% | Slightly higher |

| PA | 3.07% | ~3.1% | Flat rate, lower burden |

| CT | 6.99% | ~5.0% | Moderate top rate |

How a NJ CPA Tax Accountant Can Help

A CPA tax accountant in NJ helps you:

- Navigate complex filing rules

- Maximize credits and deductions

- Plan for retirement and investment income

- Avoid penalties or late payment fees

Schedule a consultation with Precision Accounting Intl today to optimize your NJ tax liability and get expert guidance.

Quick NJ Tax Planning Tips

- Estimate quarterly taxes if self-employed

- Track property tax credits

- Review SALT deduction limits annually

- Leverage age-based retirement exemptions

Read more:

- How to remove a tax lien in New Jersey?

- NJ property tax relief fund

- When will I receive my NJ ANCHOR payment?

Common NJ Income Tax Questions (FAQ)

Do I need to file an NJ tax return?

Yes, if your NJ gross income exceeds minimum thresholds.

How long can NJ collect back taxes?

Up to 6 years for most assessments, longer for fraud.

How much will I pay on $250,000 income?

Depends on filing status and deductions.

Can the state of NJ take money from your bank account?

Yes, for unpaid taxes after notices.

Related Articles

Services provided for you

Bookkeeping Services in Clifton, NJ

We serve a range of industries and customers, in an organized, friendly, and reliable way.

Business Tax Services

We are in a position to identify tax planning shots that reduce both your current and future tax liabilities.

Individual Tax Services

We gauge our worth by the personal and business successes of our clients and industries.

Payroll Services

For small and large corporations, payroll systems, highly qualified payroll experts support our services. Our primary objective is to provide customized services and highly favorable pricing for you.

Non-Profit Organization Services

Precision Accounting Intl can assist you set up and maintain your non-profit organizations nontaxable standing by handling all the authority reportage for you.

Part-Time CFO Services

If you"re ready enough to be in this role. Our Part-Time CFO Service Package provides you with a knowledgeable financial manager who will work with you to help guide the progress of your business.