Taxes can be stressful, confusing, and time-consuming, especially for individuals juggling multiple income sources, businesses with complex records, or expats navigating U.S. and foreign compliance. Missing a form, deduction, or deadline could mean penalties, lost refunds, or audit risk.

This complete 2026 tax prep checklist for New Jersey residents helps you organize every document, maximize deductions, and stay compliant, whether you’re filing as an individual, running a business, or living abroad.

By following this guide, you’ll know exactly what to prepare, saving time, reducing stress, and ensuring accuracy for federal, NJ state, and international filings.

Tax Prep Basics Every Filer Should Know

Filing Deadlines for NJ & Federal Taxes

- Federal 1040: April 15, 2026 (extension to October 15 if filed)

- NJ State Tax Return: April 15, 2026

- Estimated Taxes (self-employed/business owners): April 15, June 15, September 15, January 15

Missing deadlines can trigger penalties, interest, or lost credits. Plan early and schedule reminders.

Learn more: when is tax season 2026

Essential Identification & Records

- Social Security Number (SSN) or ITIN for each filer

- Prior-year NJ & federal tax returns

- Bank account info for direct deposit refunds

- IRS notices and correspondence

NJ Gross Income & State Tax Forms

Understanding NJ gross income ensures accurate reporting:

Where is NJ gross income on 1040?

- NJ gross income includes wages, self-employment income, interest, dividends, rental income, and other taxable sources

- NJ allows fewer deductions than federal, so some items may not reduce state taxes

- Include all income types for NJ compliance

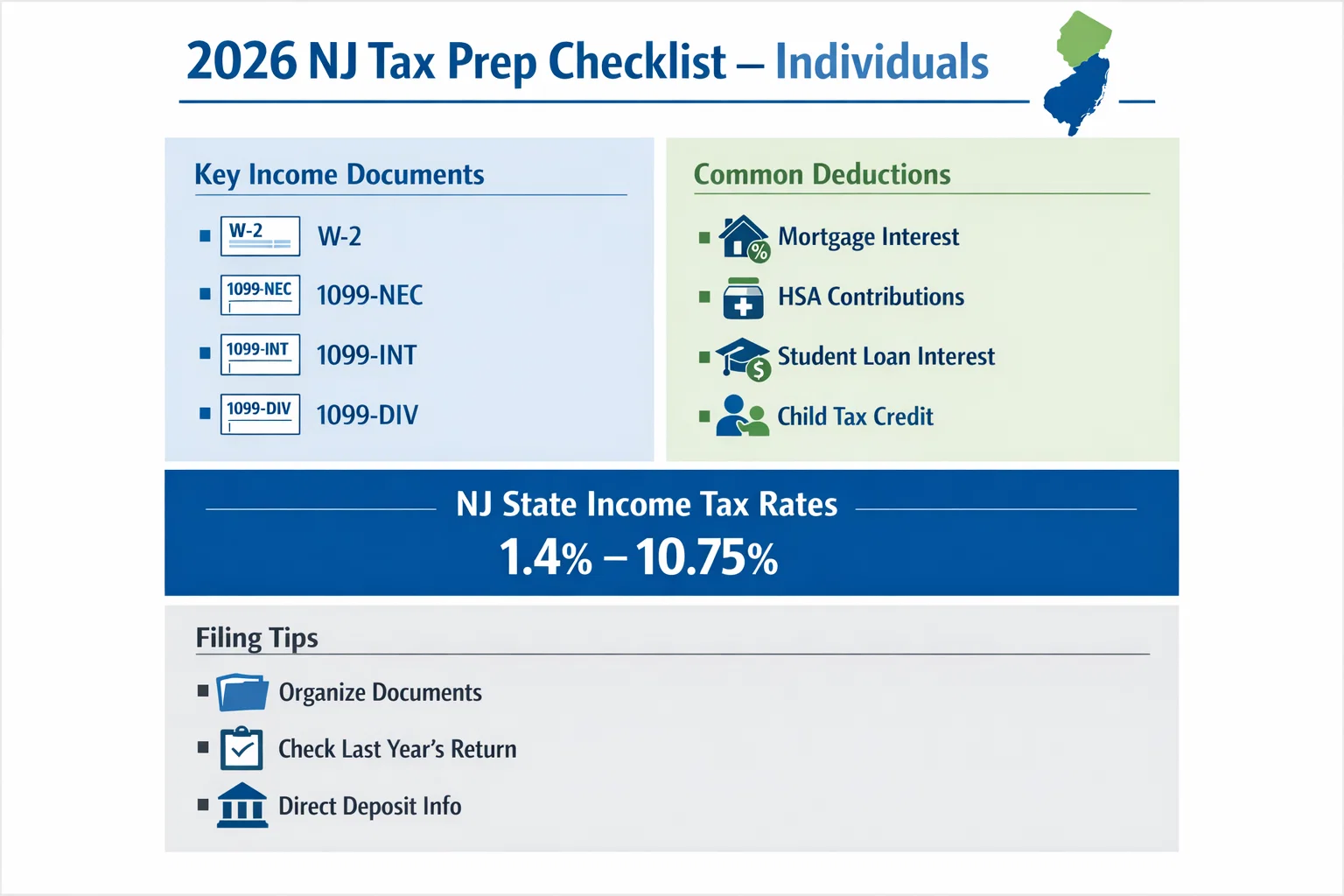

Individual Tax Prep Checklist

Income Documents

- W-2: Employer wages

- 1099 Series:

- 1099-NEC: Non-employee compensation (Read more about: 1099 forms)

- 1099-MISC: Miscellaneous income

- 1099-INT: Interest income

- 1099-DIV: Dividends and distributions

- 1099-R: Retirement plan distributions

- Other income: Rental, royalties, alimony, unemployment, cryptocurrency

Deductions & Credits

- Standard vs itemized deductions: mortgage, property taxes, medical expenses

- HSA contributions

- Student loan interest

- Child Tax Credit (CTC), Earned Income Credit (EIC)

- Retirement contributions: IRA, 401k, SEP-IRA

- Education credits: American Opportunity Credit, Lifetime Learning Credit

Filing NJ State Returns

- NJ tax rates range from 1.4% to 10.75% depending on income (Read more: New Jersey income tax)

- Deductions differ from federal; e.g., no deduction for state/local taxes paid

- Certain credits available: property tax deduction, senior freeze, earned income credit

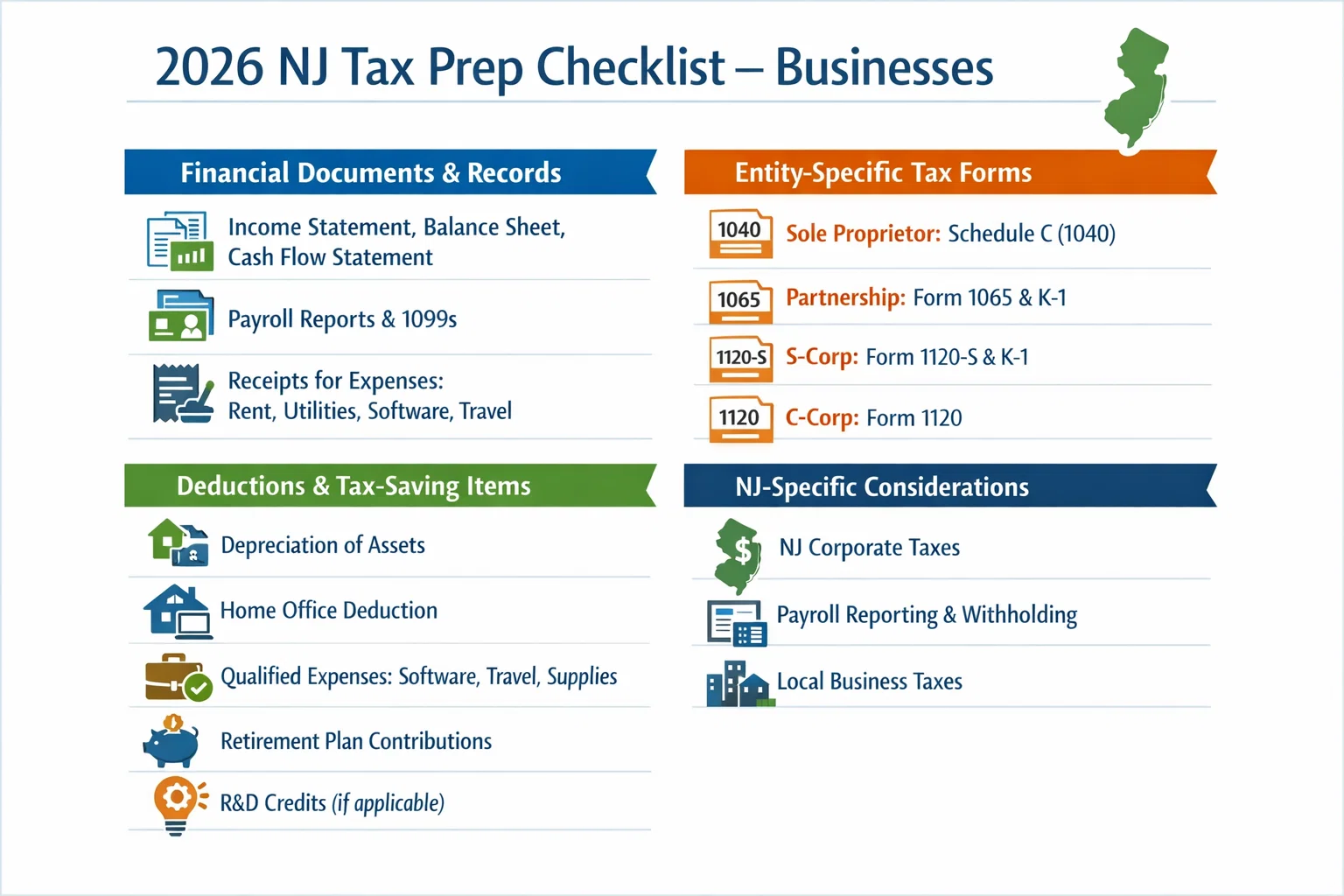

Business Tax Prep Checklist

Financial Records & Statements

- Income statements, balance sheets, cash flow statements

- Payroll reports

- 1099s issued to contractors

- Receipts for business expenses: rent, utilities, software, travel, marketing

Entity-Specific Filing Requirements

| Entity Type | Form(s) Required | Notes |

| Sole Proprietor | Schedule C (1040) | Report business income/expenses |

| Partnership | 1065 + K-1 | Each partner reports share |

| S-Corp | 1120-S + K-1 | Income passes to shareholders |

| C-Corp | 1120 | Corporate income tax |

Year-end tax planning for small business owners is essential to maximize deductions and minimize tax liability.

Business Deductions & Credits

- Depreciation schedules for assets

- Home office deduction (if applicable)

- Qualified business expenses (software, travel, marketing)

- Retirement plan contributions for employees

- R&D credit if applicable

NJ-Specific Considerations for Businesses

- NJ corporate taxes and withholding

- Employer payroll reporting

- Local city and county taxes

Year-end tax planning checklist

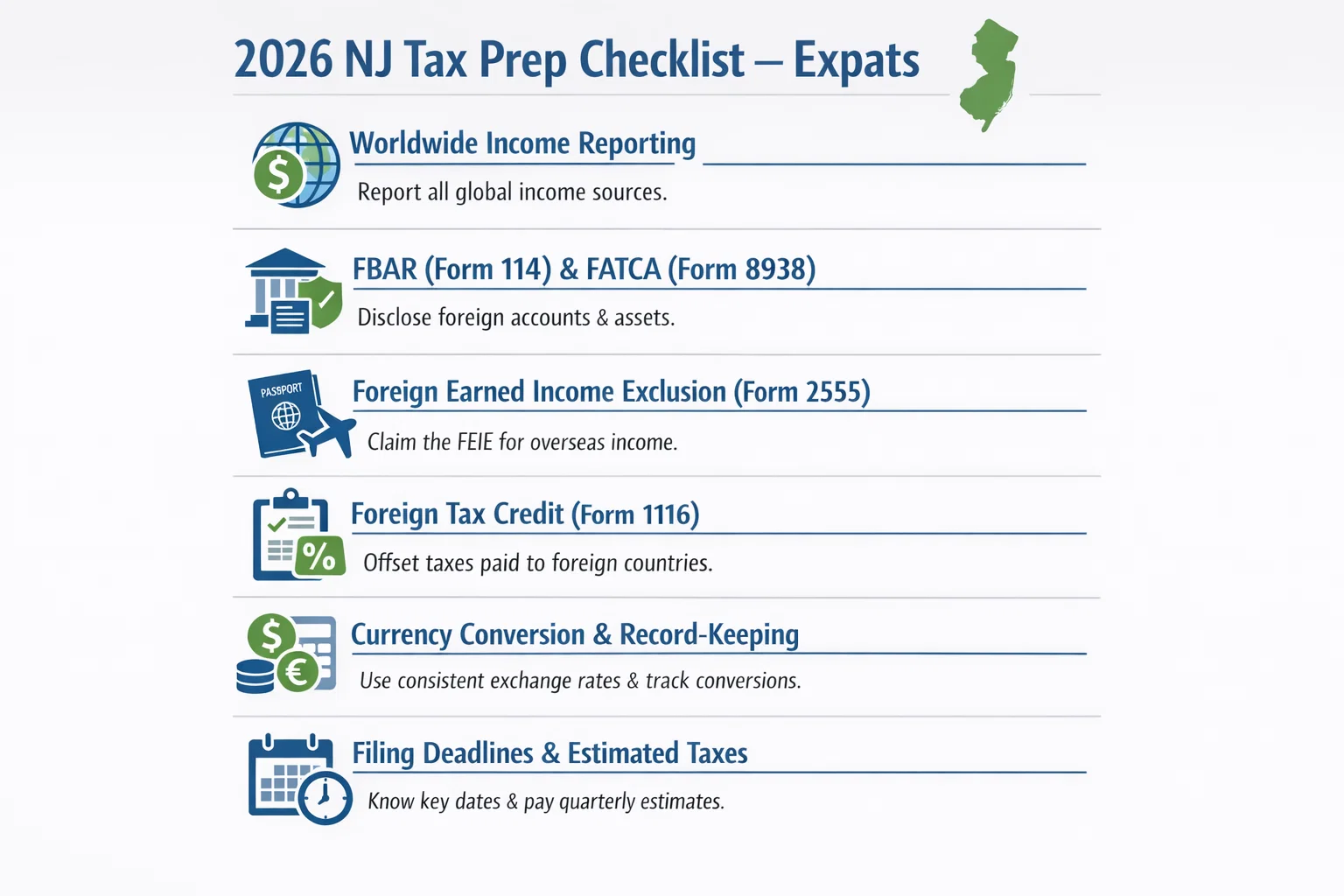

Expat Tax Prep Checklist

Worldwide Income Reporting

- All income, U.S. and foreign, must be reported

- Include wages, investment income, and foreign business income

FBAR & FATCA Compliance

- FinCEN Form 114 (FBAR): Report foreign accounts exceeding $10,000

- IRS Form 8938 (FATCA): Required for foreign financial assets

Foreign Earned Income Exclusion & Credits

- Form 2555: Exclude foreign earned income up to the annual limit

- Form 1116: Claim foreign tax credits to avoid double taxation

Currency & Documentation

- Maintain currency conversion records for income reporting

- Keep receipts, bank statements, and invoices

Deadlines & Estimated Taxes

- Quarterly estimated payments may be required

- Ensure correct calculations to avoid penalties

IRS Forms & Why They Matter

| Form | Who Files | Purpose | Key Notes |

| W-2 | Employees | Wage reporting | Must include all employers |

| 1099-NEC | Contractors | Non-employee compensation | Track freelance income |

| 1099-INT | Individuals | Interest income | Include bank, brokerage interest |

| 1099-DIV | Individuals | Dividend income | Mutual funds, stocks |

| 1040 | Individuals | Federal income tax | Base filing form |

| 1120-S | S-Corp | Corporate income tax | Shareholders report via K-1 |

| 1065 | Partnerships | Partnership income | K-1 distributed to partners |

| 2555 | Expats | Foreign earned income | Exclude qualifying foreign income |

| 1116 | Individuals | Foreign tax credit | Reduce double taxation |

Tax Prep Best Practices

- Keep organized folders for each document type

- Retain records 7+ years

- Double-check SSNs, addresses, and forms

- Review last year’s return for missing deductions

- Consider CPA guidance for complex returns (cpa firm in nj)

- Use software or checklists to track deadlines, income types, and deductions

Why Choose Precision Accounting Intl – Your NJ CPA Firm

Precision Accounting Intl provides expertise for individuals, businesses, and expats in NJ:

- Accuracy in filing and compliance

- Customized tax-saving strategies

- Efficient year-end planning, bookkeeping, and payroll

Additional Services:

- Bookkeeping services in New Jersey

- Business tax services

- Individual tax services

- Payroll services

- Tax relief service near NJ

Ready to simplify your tax season?

Contact Precision Accounting Intl, your trusted CPA firm in NJ, to ensure your 2026 taxes are fully prepared and optimized. Book a consultation today!

Related Articles

Services provided for you

Bookkeeping Services in Clifton, NJ

We serve a range of industries and customers, in an organized, friendly, and reliable way.

Business Tax Services

We are in a position to identify tax planning shots that reduce both your current and future tax liabilities.

Individual Tax Services

We gauge our worth by the personal and business successes of our clients and industries.

Payroll Services

For small and large corporations, payroll systems, highly qualified payroll experts support our services. Our primary objective is to provide customized services and highly favorable pricing for you.

Non-Profit Organization Services

Precision Accounting Intl can assist you set up and maintain your non-profit organizations nontaxable standing by handling all the authority reportage for you.

Part-Time CFO Services

If you"re ready enough to be in this role. Our Part-Time CFO Service Package provides you with a knowledgeable financial manager who will work with you to help guide the progress of your business.