The difference between scrambling at tax time and confidently reducing your tax bill often comes down to what you do before December 31.

Too many small business owners realize, too late, that missed deductions, poor timing, or ignored NJ-specific rules cost them thousands of dollars.

If you run a business in New Jersey, year end tax planning for small business owners is not optional, it is strategic risk management.

This guide shows you:

- What actions actually lower your tax liability before year-end

- How NJ tax rules change the planning conversation

- Which decisions require a CPA, not guesswork

Proactive year-end tax planning can legally reduce your business taxes by thousands, but only if done before December 31.

Why Year-End Tax Planning Matters More in New Jersey

New Jersey business owners face federal + state tax exposure, often with fewer deductions at the state level.

Key realities:

- NJ does not allow the federal QBI deduction

- State income tax rates are progressive and unforgiving

- Payroll, sales tax, and entity compliance errors compound quickly

Understanding What is the NJ state income tax rate? early allows you to model accurate year-end decisions instead of reacting in April.

Without planning:

- Income is taxed at higher marginal rates

- Deductions expire unused

- Cash flow suffers during tax season

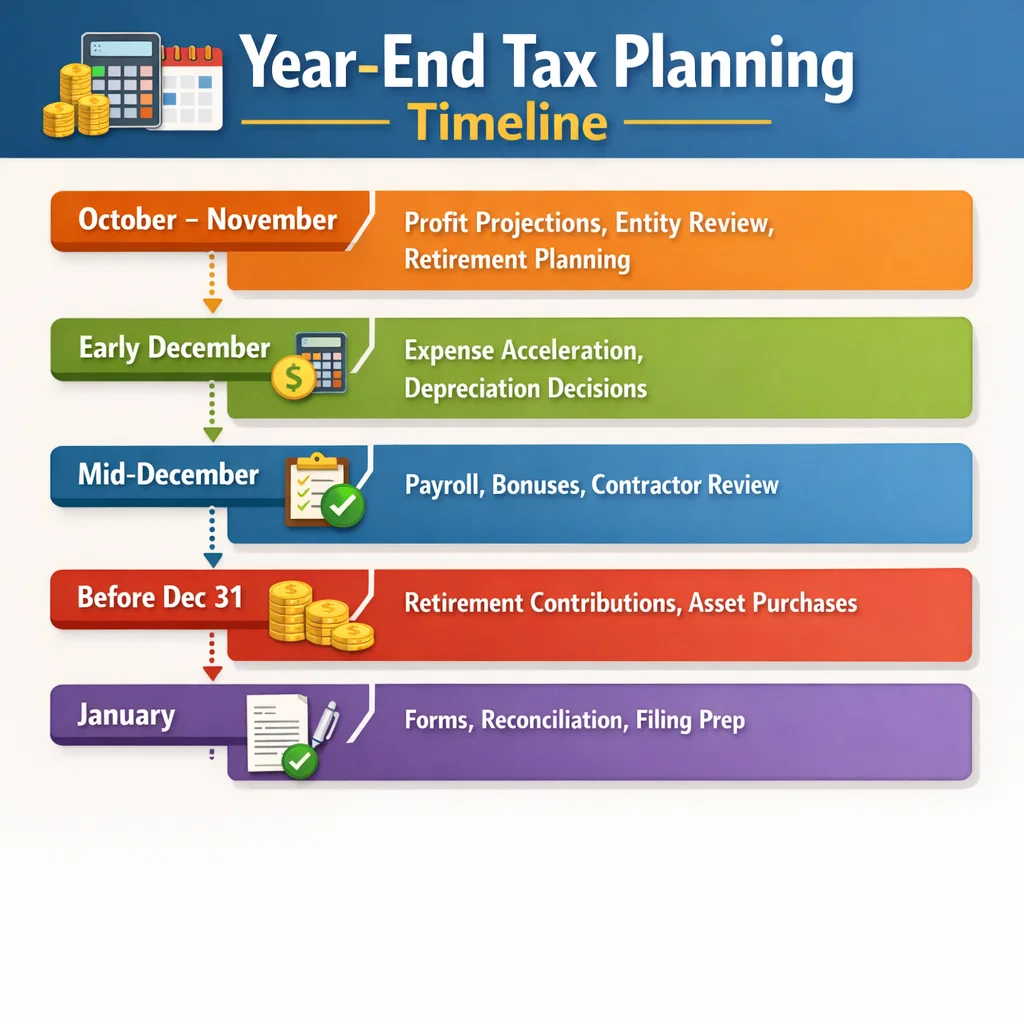

Year-End Tax Planning Timeline (NJ Business Owners)

| Timeframe | What Should Be Done |

| October–November | Profit projections, entity review, retirement planning |

| Early December | Expense acceleration, depreciation decisions |

| Mid-December | Payroll, bonuses, contractor review |

| Before Dec 31 | Retirement contributions, asset purchases |

| January | Forms, reconciliation, filing prep |

Knowing when is tax season 2026 helps reverse-engineer smarter year-end decisions.

1. Project Your Business Income Before December 31

You cannot reduce taxes if you do not know your numbers.

A proper projection includes:

- Gross revenue

- Operating expenses

- Payroll

- Owner compensation

- Estimated NJ tax exposure (Where is NJ gross income on 1040?)

This is where accurate bookkeeping services in new Jersey become non-negotiable.

CPA insight: Tax planning without clean books is speculation, not strategy.

2. Accelerate Expenses Strategically (Not Blindly)

Expense timing is one of the most effective year-end levers.

Examples:

- Prepay rent or insurance

- Purchase supplies needed in Q1

- Invest in technology or equipment

Depreciation strategies must be coordinated with entity structure and long-term plans, especially for NJ businesses. See year end tax planning for businesses for a detailed approach.

3. Section 179 and Bonus Depreciation Decisions

Large purchases should never be made “just for the deduction.”

Consider:

- Cash flow impact

- State conformity differences

- Future depreciation needs

A CPA evaluates whether immediate expensing or spreading deductions is optimal.

4. Retirement Planning: One of the Largest Legal Tax Shelters

For profitable NJ business owners, retirement plans are often underused.

Options include:

- SEP-IRA

- Solo 401(k)

- Profit-sharing plans

Strategic contributions align closely with retirement planning in NJ and year-end tax mitigation.

5. Payroll, Bonuses, and Owner Compensation

Year-end payroll decisions directly affect:

- Employer payroll taxes

- Owner self-employment tax

- NJ withholding accuracy (form w-4)

This is where payroll near you in NJ integrated with tax strategy prevents costly errors.

Also review:

- Bonus timing

- Fringe benefits

- Health insurance deductions

6. Independent Contractors and 1099 Compliance

Misclassification and late reporting are frequent audit triggers.

Before year-end:

- Review all contractors

- Confirm W-9s

- Prepare for 1099 forms 1099-INT, 1099-DIV

Incorrect handling here can undo otherwise strong tax planning.

7. Entity Structure Review (LLC, S-Corp, C-Corp)

Your entity structure determines:

- How profits are taxed

- Exposure to self-employment tax

- NJ filing obligations

Many business owners operate in the wrong structure for years.

Year-end is the last window to evaluate:

- S-Corp elections

- Reasonable salary modeling

- Pass-through tax efficiency, read: (Tax planning strategies for companies)

8. NJ-Specific Tax Considerations Most Blogs Miss

Most national guides ignore NJ nuances.

Critical NJ considerations:

- No QBI deduction

- Gross income reporting rules, read: (Where is NJ gross income on 1040?)

- State estimated tax thresholds

9. Estimated Tax Payments and Cash Flow Control

Underpayment penalties are avoidable.

Before December 31:

- Review quarterly estimates

- Adjust final payments

- Align projections with reality

This connects directly with How to file the Income Tax Return online? when accuracy matters most.

10. W-4 and Withholding Adjustments

Owner-employees often overlook withholding optimization.

Updating form w-4 at year-end can:

- Reduce April balances due

- Improve cash flow predictability

- Align payroll with tax reality

11. Personal and Business Planning Must Align

Owners often plan business taxes separately from personal exposure, this is a mistake.

Integrated planning considers:

- Business income

- Personal deductions

- Investment income

- Family tax goals, read: (Tax planning strategies for individuals)

12. Comparison: DIY Tax Planning vs CPA-Led Planning

| Area | DIY Approach | CPA-Led Strategy |

| Projections | Guesswork | Modeled scenarios |

| NJ compliance | Reactive | Proactive |

| Deductions | Missed | Maximized |

| Audit risk | High | Controlled |

| Peace of mind | Low | High |

Working with the best accounting firm in nj changes outcomes, not just filings.

Why Precision Accounting Intl Is Different

At Precision Accounting Intl, we do not “prepare taxes.”

We engineer outcomes.

As a trusted cpa firm in nj, we help business owners:

- Reduce tax liability legally

- Align business and personal strategy

- Stay compliant with NJ and federal rules

- Plan before deadlines, not after

Our services include:

- business tax services

- indivedual tax services new jersey

- tax accountant nj

- part-time cfo services

- online service bookkeeping usa

- tax relief service near nj

Meet our lead CPA: Amr Ibrahim, CPA , strategic advisor, not just a filer.

When to Take Action (Not Later)

If you wait until January:

- Options disappear

- Mistakes compound

- Stress increases

Year-end tax planning only works before December 31.

Do not let another year pass without a strategy.

If you are a New Jersey small business owner and want:

- Lower taxes

- Fewer surprises

- Clear, proactive guidance

Schedule a year-end tax planning consultation with Precision Accounting Intl today.

Your future cash flow depends on what you decide now.

Related Articles

Services provided for you

Bookkeeping Services in Clifton, NJ

We serve a range of industries and customers, in an organized, friendly, and reliable way.

Business Tax Services

We are in a position to identify tax planning shots that reduce both your current and future tax liabilities.

Individual Tax Services

We gauge our worth by the personal and business successes of our clients and industries.

Payroll Services

For small and large corporations, payroll systems, highly qualified payroll experts support our services. Our primary objective is to provide customized services and highly favorable pricing for you.

Non-Profit Organization Services

Precision Accounting Intl can assist you set up and maintain your non-profit organizations nontaxable standing by handling all the authority reportage for you.

Part-Time CFO Services

If you"re ready enough to be in this role. Our Part-Time CFO Service Package provides you with a knowledgeable financial manager who will work with you to help guide the progress of your business.