In New Jersey, most income is taxable, including wages, business and self-employment income, dividends, interest, capital gains, rental income, pensions, and certain retirement account distributions. Some income, such as Social Security benefits and certain pension types, may be partially or fully exempt. Reporting all taxable income accurately ensures you avoid penalties and maximize potential deductions.

Many New Jersey residents overpay taxes or face unexpected penalties simply because they aren’t fully aware of what counts as taxable income. From traditional wages to freelance earnings, business profits, or investment gains, the rules can be complex. Understanding NJ-specific taxable income rules and exemptions is essential for residents, nonresidents, and part-year filers alike.

By the end, you’ll know exactly what income to report, how to calculate taxable income, and how to reduce your liability legally.

How New Jersey Defines Taxable Income

New Jersey defines taxable income broadly, but there are important differences from federal rules:

- Gross Income: Includes wages, salaries, business income, investments, and certain retirement distributions.

- Residents vs Nonresidents: Residents are taxed on all income; nonresidents are taxed only on NJ-source income.

- Required Forms: NJ-1040 for residents; NJ-1040NR for nonresidents.

Read more: Where is NJ gross income on 1040?

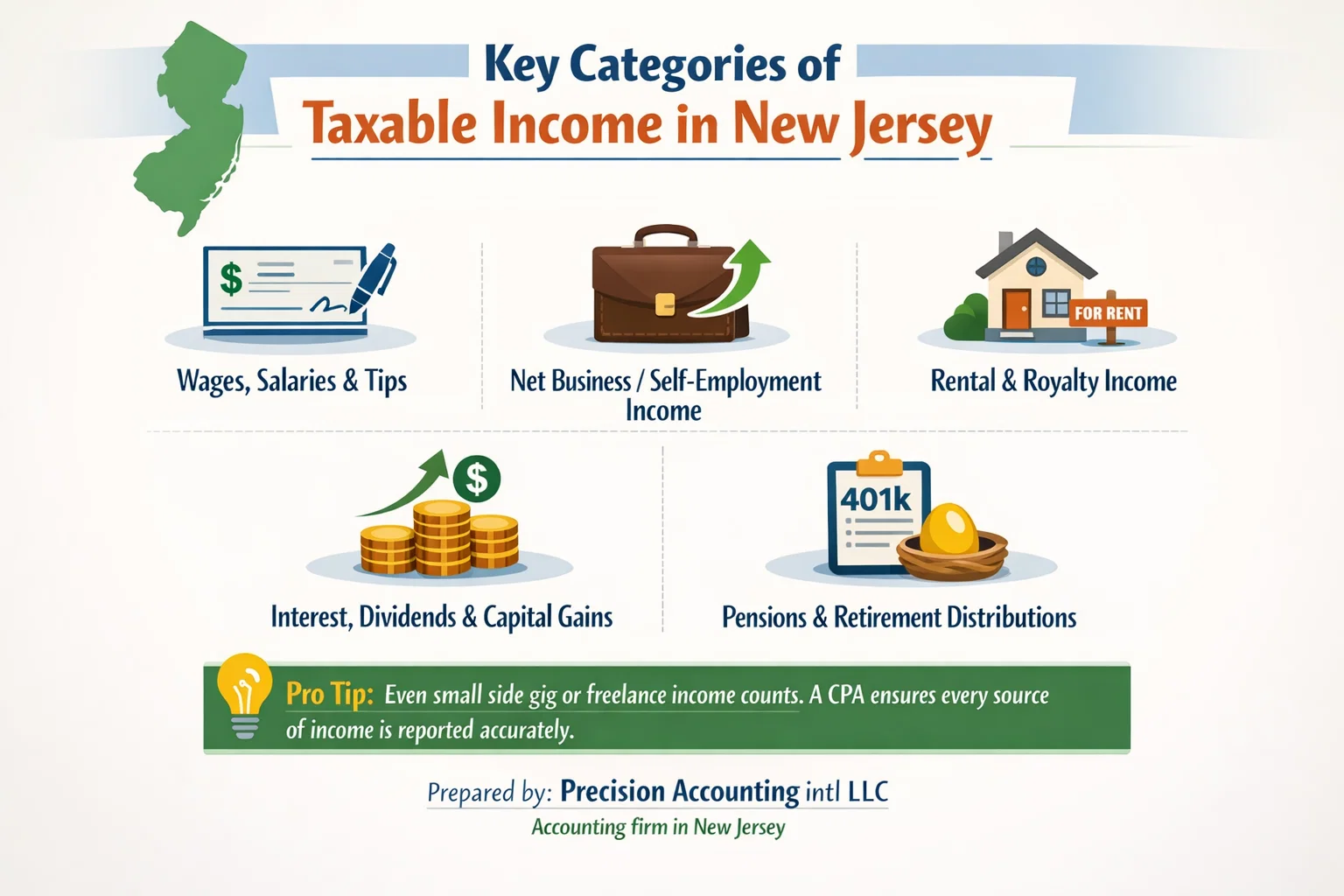

Categories of Taxable Income

- Wages, salaries, and tips

- Net business or self-employment income

- Rental and royalty income

- Interest, dividends, and capital gains

- Pensions and retirement account distributions

Pro Tip: Even small side gig or freelance income counts. A CPA ensures every source of income is reported accurately.

Wages and Salary Income

Wages are the most common source of taxable income for NJ residents.

Key Points:

- NJ requires adjustments to federal wages in certain situations.

- All types of compensation—overtime, commissions, bonuses—are taxable.

- W‑2 Box 16 shows NJ taxable wages.

Read more: Form W-4

Tips:

- Report all wages, even if earned across multiple states.

- Include supplemental wages and fringe benefits.

Reminder:

“All NJ residents must report wages earned from NJ employers, even if you also file federally.”

Business and Self-Employment Income

If you run a business or are self-employed, your NJ taxable income includes:

- Sole proprietorship net income

- Partnership and S Corporation pass-through income

- Freelance or contract earnings

Key Considerations:

- NJ requires reporting net income after business expenses.

- Certain state-specific deductions may apply.

Read more:

Comparison Table:

| Income Type | Federal Taxable? | NJ Taxable? | Notes |

| Sole Proprietor Income | Yes | Yes | Net after business expenses |

| S Corp Pass-through | Yes | Yes | Allocated based on share |

| Partnership Income | Yes | Yes | NJ treats as pass-through |

Investment and Passive Income

New Jersey taxes many types of investment and passive income:

- Dividends and interest (Form 1099-INT, 1099-DIV)

- Capital gains

- Rental income

- Royalties

Read more: 1099 forms: 1099-INT, 1099-DIV

Tips:

- Keep detailed records of all investment activity.

- NJ generally follows federal classification but may differ for specific deductions.

Insight:

“Even small dividends or rental profits can increase your taxable income significantly in NJ.”

Retirement and Pension Income

NJ has special rules for retirement income:

- Social Security benefits: Often fully exempt.

- Pensions and IRAs: Some are partially exempt depending on age and income.

- Deferred compensation: Taxable under NJ rules.

Read more: Retirement planning in NJ

Example:

John, a 65-year-old retiree, reports $50,000 pension income and $12,000 Social Security. Only the pension is fully taxable in NJ; Social Security is partially exempt.

Other Taxable Income in New Jersey

Additional taxable income includes:

- Unemployment compensation

- Gambling winnings

- Royalties

- Settlements or awards

Pain Point Reminder:

“Failing to report even one source of income can trigger audits or penalties—Precision Accounting Intl ensures every dollar is correctly reported.”

Income Not Taxable in New Jersey

Some income is exempt or partially exempt:

- Social Security (full or partial)

- Certain pension distributions

- Life insurance proceeds

- Scholarships/fellowships (conditions apply)

Tip:

“Knowing what’s exempt prevents unnecessary tax payments.”

Non-Residents and Part-Year Residents

NJ taxes nonresidents only on NJ-source income:

- Salary earned in NJ

- Business income from NJ operations

- Rental income from NJ properties

Credits are available for taxes paid to other states.

Read more: Tax Prep Checklist for Individuals, Business, and Expats

How to Calculate Your NJ Taxable Income

Step-by-step approach:

- Add all sources of taxable income

- Subtract any NJ-allowed exemptions/deductions

- Determine NJ AGI

- Apply NJ income tax rates

Read more:

Comparison Table – Taxable vs Non-Taxable Income:

| Income Type | Taxable in NJ? |

| Wages & Salaries | Yes |

| Business Income | Yes |

| Dividends & Interest | Yes |

| Social Security | Partial/No |

| Life Insurance Proceeds | No |

| Scholarships | Conditional |

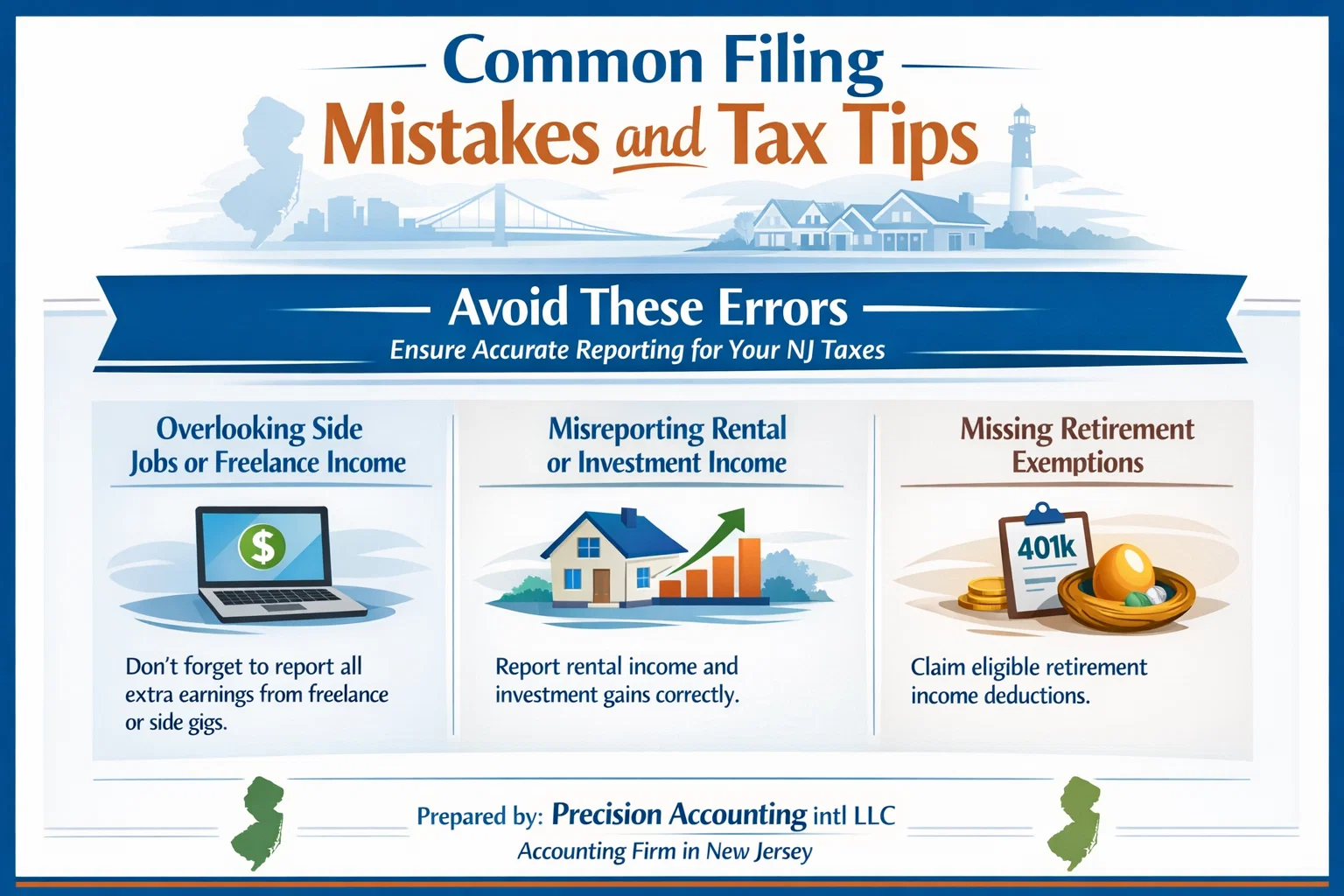

Common Filing Mistakes and Tax Tips

Avoid These Errors:

- Overlooking side jobs or freelance income

- Misreporting rental or investment income

- Missing retirement exemptions

Read more:

- Year-end tax planning for small business owners

- Tax planning strategies for individuals

- Year-end tax planning checklist

Tip: Precision Accounting Intl helps you identify deductions and exemptions you might otherwise miss.

Why Work with a CPA Firm in New Jersey

Benefits of hiring Precision Accounting Intl:

- Maximize deductions & exemptions

- Avoid penalties and audits

- Personalized guidance for residents, businesses, and expats

Read more:

“Ensure every dollar is reported correctly and maximize your NJ tax savings. Contact Precision Accounting Intl today to schedule your consultation with a trusted CPA expert!”

FAQs

1. What income is considered taxable in New Jersey?

All wages, business profits, dividends, interest, capital gains, rental income, and most pensions.

2. Are Social Security benefits taxable in NJ?

Partially or fully exempt depending on your income.

3. How does NJ treat business income for self-employed individuals?

All net business income is taxable after allowable NJ deductions.

4. Do I need to report rental or investment income in NJ?

Yes. Rental, dividends, interest, and capital gains are all taxable.

5. What forms do I need for filing NJ state taxes?

Use NJ-1040 (residents) or NJ-1040NR (nonresidents).

Related Articles

Services provided for you

Bookkeeping Services in Clifton, NJ

We serve a range of industries and customers, in an organized, friendly, and reliable way.

Business Tax Services

We are in a position to identify tax planning shots that reduce both your current and future tax liabilities.

Individual Tax Services

We gauge our worth by the personal and business successes of our clients and industries.

Payroll Services

For small and large corporations, payroll systems, highly qualified payroll experts support our services. Our primary objective is to provide customized services and highly favorable pricing for you.

Non-Profit Organization Services

Precision Accounting Intl can assist you set up and maintain your non-profit organizations nontaxable standing by handling all the authority reportage for you.

Part-Time CFO Services

If you"re ready enough to be in this role. Our Part-Time CFO Service Package provides you with a knowledgeable financial manager who will work with you to help guide the progress of your business.