Your paycheck should not feel like a mystery. Yet for many New Jersey employees, Form W-4 is the reason their take-home pay suddenly changes, or why they owe the IRS and the state every tax season.

Form W-4 tells your employer exactly how much federal income tax to withhold from your paycheck.

In New Jersey, it works alongside (not instead of) the NJ-W4, making accuracy even more critical.

This guide explains how Form W-4 works, how to fill it out correctly in New Jersey, and how to avoid costly withholding mistakes, with expert insight from a trusted tax accountant in NJ.

What Is Form W-4 and Why It Matters in New Jersey

Form W-4 (Employee’s Withholding Certificate) is the document employees use to instruct employers how much federal income tax to withhold from each paycheck.

If your W-4 is wrong:

- You may owe taxes unexpectedly

- Your paycheck may shrink unnecessarily

- Refunds may be misleading or delayed

In New Jersey, W-4 errors often compound because state withholding follows different rules, making professional review especially important for residents.

How Form W-4 Works After the IRS Redesign

Many taxpayers are still confused by the post-2020 version of Form W-4.

Why Allowances Were Removed

The IRS eliminated allowances to improve accuracy and reduce under-withholding. Instead, the form now focuses on:

- Total household income

- Credits

- Other earnings

- Deductions

Why NJ Employees Often Under-Withhold

New Jersey does not mirror federal withholding logic exactly. This disconnect causes many taxpayers to owe when filing both federal and state returns.

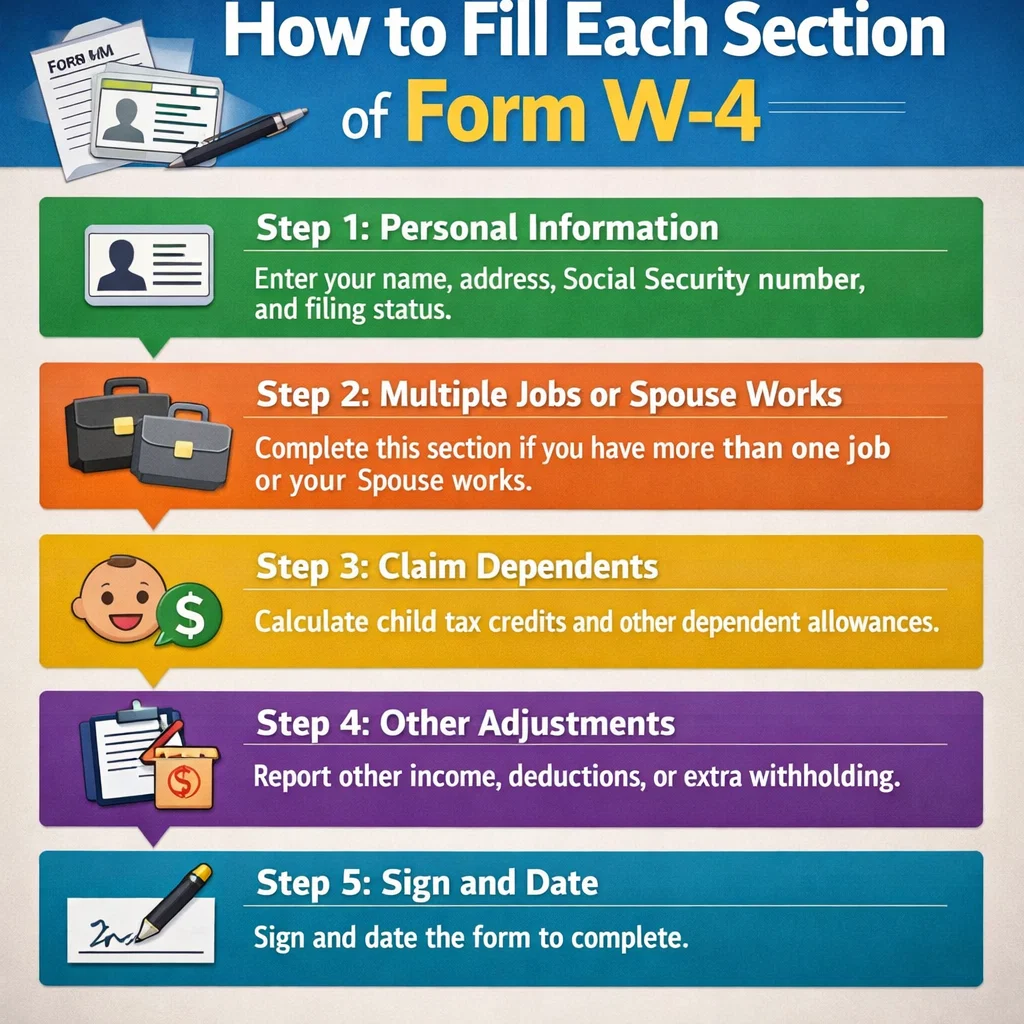

How to Fill Out Form W-4 Step by Step (NJ-Specific Guidance)

Step 1: Personal Information

Enter your name, address, and filing status carefully. Choosing the wrong status can distort withholding immediately.

Step 2: Multiple Jobs or Working Spouse

If you or your spouse work more than one job, failing to complete this section correctly is one of the most common NJ tax mistakes.

Step 3: Claiming Dependents

Only claim dependents if you meet IRS qualifications. Overstating credits leads to under-withholding.

Step 4: Other Income and Deductions

Side income, interest, and gig work should be disclosed here to avoid tax surprises.

Step 5: Final Review

Sign only after confirming accuracy. Even a small error can impact every paycheck.

Form W-4 vs NJ-W4: What’s the Difference?

Many New Jersey taxpayers assume one form covers everything. It does not.

| Feature | Form W-4 | NJ-W4 |

| Applies to | Federal tax | New Jersey state tax |

| Issued by | IRS | NJ Division of Taxation |

| Allowances | No | Yes |

| Required in NJ | Yes | Yes |

Both forms must be completed correctly to avoid balance-due issues.

Common Form W-4 Mistakes New Jersey Taxpayers Make

- Ignoring spouse or second-job income

- Assuming NJ withholding matches federal rules

- Forgetting to update after marriage or children

- Never reviewing withholding annually

These errors often surface when clients consult a tax accountant in NJ for unexpected balances.

When You Should Update Your Form W-4

You should update your W-4 after any major life or income change, including:

- Marriage or divorce

- Birth of a child

- Second job

- Retirement income

Planning ahead is especially important as outlined in when is tax season 2026

How Form W-4 Affects Your Tax Refund or Balance Due

A refund is not free money, it often means you overpaid throughout the year.

Understanding What is the NJ state income tax rate? helps ensure your withholding aligns with reality:

Errors also affect reporting, especially Where is NJ gross income on 1040?

Special Scenarios for New Jersey Taxpayers

Multiple Jobs and Gig Work

NJ residents with side income often need customized withholding strategies supported by business tax services

Retirement Income

Improper withholding on pensions or distributions can trigger penalties without proper retirement planning in NJ

Should You Use the IRS Withholding Estimator?

The estimator is useful, but it does not account for all NJ-specific factors. Many taxpayers benefit from professional validation through individual tax services New Jersey

How a New Jersey Tax Accountant Helps You Get W-4 Right

A CPA evaluates:

- Household income

- State vs federal interaction

- Payroll accuracy

- Long-term tax efficiency

Precision Accounting Intl offers comprehensive support as a trusted tax accountant NJ

Our expertise spans:

- payroll near you in NJ

- bookkeeping services in New Jersey

- online service bookkeeping usa

- tax relief service near nj

- part-time cfo services

Led by Amr Ibrahim, CPA, our guidance is grounded in real NJ tax outcomes:

Get Your Withholding Right with Precision Accounting Intl

Form W-4 mistakes cost New Jersey taxpayers thousands every year. A quick review can prevent penalties, protect your cash flow, and eliminate guesswork.

If you want clarity, confidence, and year-round support from the best accounting firm in nj, schedule a consultation today:

And if you’re planning ahead, proactive guidance through year end tax planning for businesses ensures your withholding strategy stays optimized:

Frequently Asked Questions About Form W-4 in NJ

Do NJ residents need both forms?

Yes. Federal and state withholding are separate requirements.

How often can I change my W-4?

Any time your income or family situation changes.

Why do I owe every year?

Under-withholding is common without professional review from a cpa firm in nj:

Related Articles

Services provided for you

Bookkeeping Services in Clifton, NJ

We serve a range of industries and customers, in an organized, friendly, and reliable way.

Business Tax Services

We are in a position to identify tax planning shots that reduce both your current and future tax liabilities.

Individual Tax Services

We gauge our worth by the personal and business successes of our clients and industries.

Payroll Services

For small and large corporations, payroll systems, highly qualified payroll experts support our services. Our primary objective is to provide customized services and highly favorable pricing for you.

Non-Profit Organization Services

Precision Accounting Intl can assist you set up and maintain your non-profit organizations nontaxable standing by handling all the authority reportage for you.

Part-Time CFO Services

If you"re ready enough to be in this role. Our Part-Time CFO Service Package provides you with a knowledgeable financial manager who will work with you to help guide the progress of your business.