Wondering when you’ll receive your NJ ANCHOR payment? Most eligible homeowners and renters in New Jersey receive their ANCHOR benefits within 90 days of applying. This guide explains how to check your NJ ANCHOR payment status, what different ANCHOR check status messages mean, and what can affect when your rebate is issued.

ANCHOR Payment Update (2026 Cycle)

As part of the current ANCHOR payment cycle, the New Jersey Division of Taxation is issuing payments on a rolling, batch-based basis. Processing timelines vary depending on filing method, verification requirements, and application volume. Status updates may not appear immediately after approval.

Professional accounting firms in nj can also assist with complex application corrections.

NJ ANCHOR Check Status: What Each Status Means

| Status Message | What It Means | What You Should Do |

| Under Review | Your application is being verified by the NJ Division of Taxation | No action required unless contacted |

| Approved | Your ANCHOR benefit has been authorized | Expect payment processing |

| Issued | Payment has been sent by direct deposit or check | Allow delivery time |

| Pending Verification | Additional review is required | Monitor notices or status updates |

ANCHOR status updates are not real-time. It may take several business days for the system to reflect changes after approval or payment issuance.

What is the ANCHOR Program?

At its core, the ANCHOR Program is New Jersey's commitment to providing meaningful property tax relief. It was launched in 2022, building upon and expanding the former Homestead Benefit program. The primary purpose of this initiative is to alleviate the burden of property taxes for eligible homeowner relief and renter relief across the state.

You may be interested in Tax Accountant in New Jersey.

Who is Eligible for the ANCHOR Benefit?

Eligibility for the NJ ANCHOR (Affordable New Jersey Communities for Homeowners and Renters) benefit is based on your housing status, New Jersey residency, and New Jersey gross income for the prior tax year.

For ANCHOR payments expected to be issued in 2026, eligibility will be determined using your 2025 New Jersey gross income. The program is administered by the New Jersey Division of Taxation, and applicants must qualify either as a homeowner or a renter under state guidelines.

Income limits and program rules are finalized by the state each year and are subject to legislative and budget approval.

Homeowner Eligibility

You may qualify for an ANCHOR payment as a homeowner for the 2026 benefit year if you meet all of the following conditions:

- You owned and occupied a residential property in New Jersey as your primary residence

- The property was subject to New Jersey property taxes

- Your 2025 New Jersey gross income falls within the eligibility limits set by the state for the 2026 benefit year

- You met New Jersey residency requirements during the applicable period

Based on prior ANCHOR benefit years, the state has historically set the homeowner income cap at $250,000, though final income limits for 2026 payments will be confirmed by the New Jersey Division of Taxation.

Only one ANCHOR benefit is issued per eligible property, even if multiple owners are listed. Situations involving joint ownership, partial-year residency, marital changes, or property transfers may require additional review and can affect processing timelines.

Renter Eligibility

You may qualify for the NJ ANCHOR benefit as a renter for payments expected in 2026 if the following apply:

- You rented and lived in a New Jersey residence as your primary home

- The rental property was subject to local New Jersey property taxes

- Your 2025 New Jersey gross income is within the renter income limits established for the 2026 benefit year

- Your name appeared on the lease or rental agreement

- You satisfied New Jersey residency requirements during the benefit year

Historically, the renter income limit has been set at $150,000, though final thresholds for the 2026 payment cycle will be issued by the state.

Because renters do not receive property tax bills directly, the state applies a standardized formula to estimate the property tax portion of rent when calculating the ANCHOR benefit.

Renters who moved during the year, changed leases, or experienced income fluctuations may still qualify, but these cases often require additional verification.

Important Eligibility Notes

ANCHOR eligibility is based on New Jersey gross income, not federal adjusted gross income

When to Expect Your NJ ANCHOR Payment?

For ANCHOR applications filed in 2025, most eligible New Jersey homeowners and renters can expect their ANCHOR payment to be issued in 2026. The New Jersey Division of Taxation processes ANCHOR benefits on a rolling basis, meaning there is no single statewide payment date.

In general, once an application is accepted and verified, payments are typically issued within approximately 90 days, although actual timing can vary depending on several factors such as filing method, verification requirements, and application volume.

Because payments are released in batches, two applicants who file on the same day may still receive their payments at different times.

What If My ANCHOR Status Says “Issued” but I Haven’t Received Payment?

- Confirm delivery method (direct deposit vs check)

- Verify bank account or mailing address

- Allow sufficient processing time before contacting the state

- Returned checks or failed deposits may require reissuance

In some cases, a payment trace may be required before the New Jersey Division of Taxation can reissue the benefit.

How to Check Your NJ ANCHOR Payment Status

The official ANCHOR payment status checker is the only authorized tool for tracking your NJ ANCHOR benefit.

ANCHOR status tracking is available during active filing and payment cycles through the New Jersey Division of Taxation website.

- Visit the NJ Division of Taxation website

- Enter your Social Security Number and required identifying information

- Review your application and payment status

The system may show whether your application is under review, approved, or if a payment has been issued.

Status information is updated in batches and may not change daily. Seeing the same status for several days is normal and does not necessarily indicate a problem with your application.

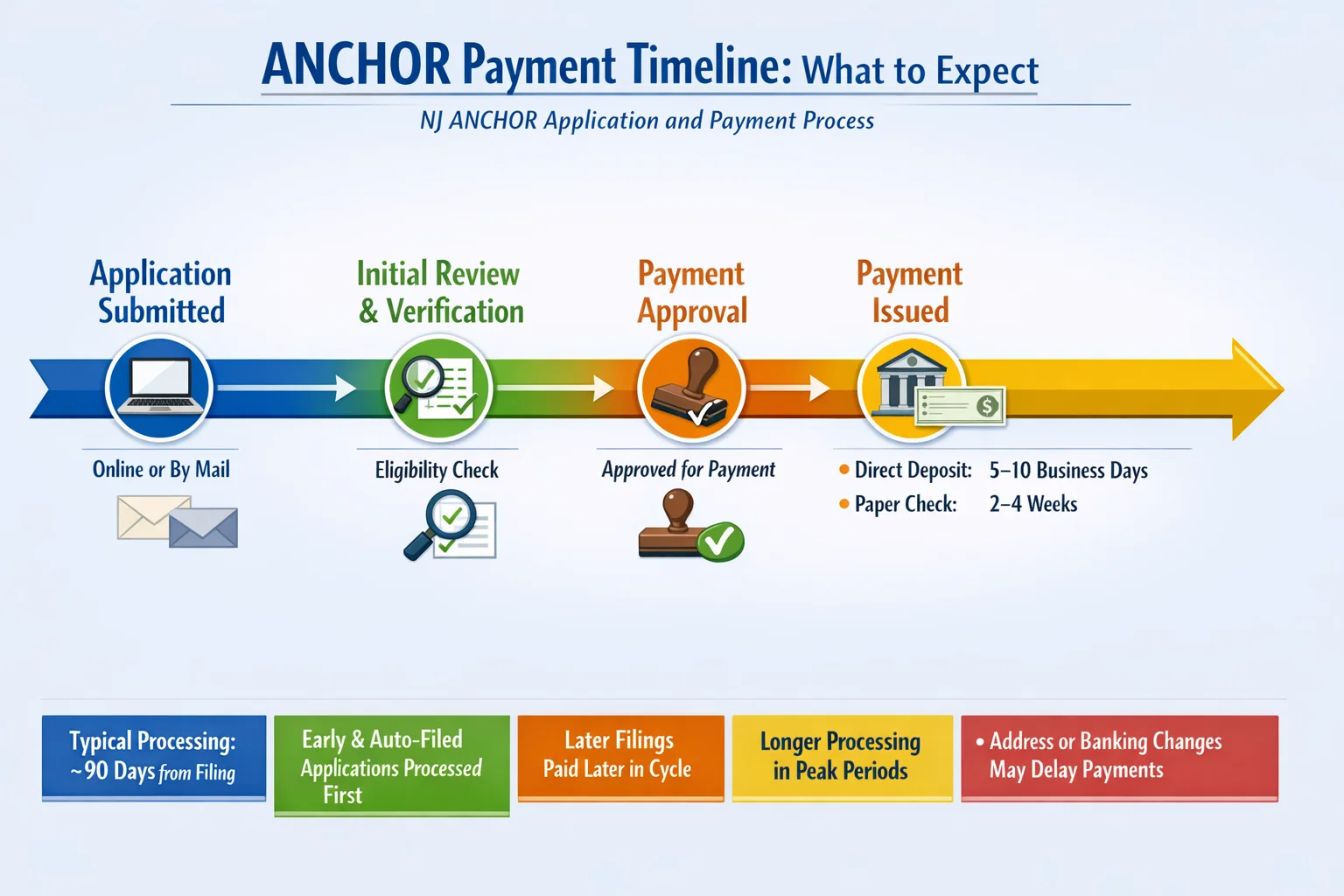

ANCHOR Payment Timeline

While the state does not publish a fixed payment schedule, the typical ANCHOR processing flow follows this pattern:

- Application submitted (online or by mail)

- Initial review and verification

- Payment approval

- Payment issued (direct deposit or paper check)

For most applicants:

- Payments are issued within about 90 days of filing

- Early filers and auto-filed applicants are often processed first

- Later filings may be paid later in the payment cycle

- Direct deposit payments typically arrive 5–10 business days after status shows “Issued”

- Paper checks may take 2–4 weeks after issuance

- Processing times may be longer during peak filing periods

Applicants with address changes, banking updates, or income discrepancies commonly experience longer ANCHOR processing timelines.

Factors That Affect ANCHOR Payment Timing

Several variables can influence how quickly you receive your NJ ANCHOR payment:

- Filing date: Earlier applications are typically processed sooner

- Application type: Auto-filed applications are usually paid faster

- Filing method: Online filings generally process faster than mailed forms

- Verification requirements: Identity, income, or residency checks, or manual verification, can add time to processing.

- Application accuracy: Errors or missing information cause delays, even when applications are accurate, status update delays can occur, so seeing the same status for several days is normal.

- Seasonal volume: Peak filing periods slow overall processing

Even when eligibility is clear, these factors can impact when a payment is actually issued.

If a payment cannot be received due to an address or banking issue, a payment trace may be required before the NJ Division of Taxation can reissue the benefit.

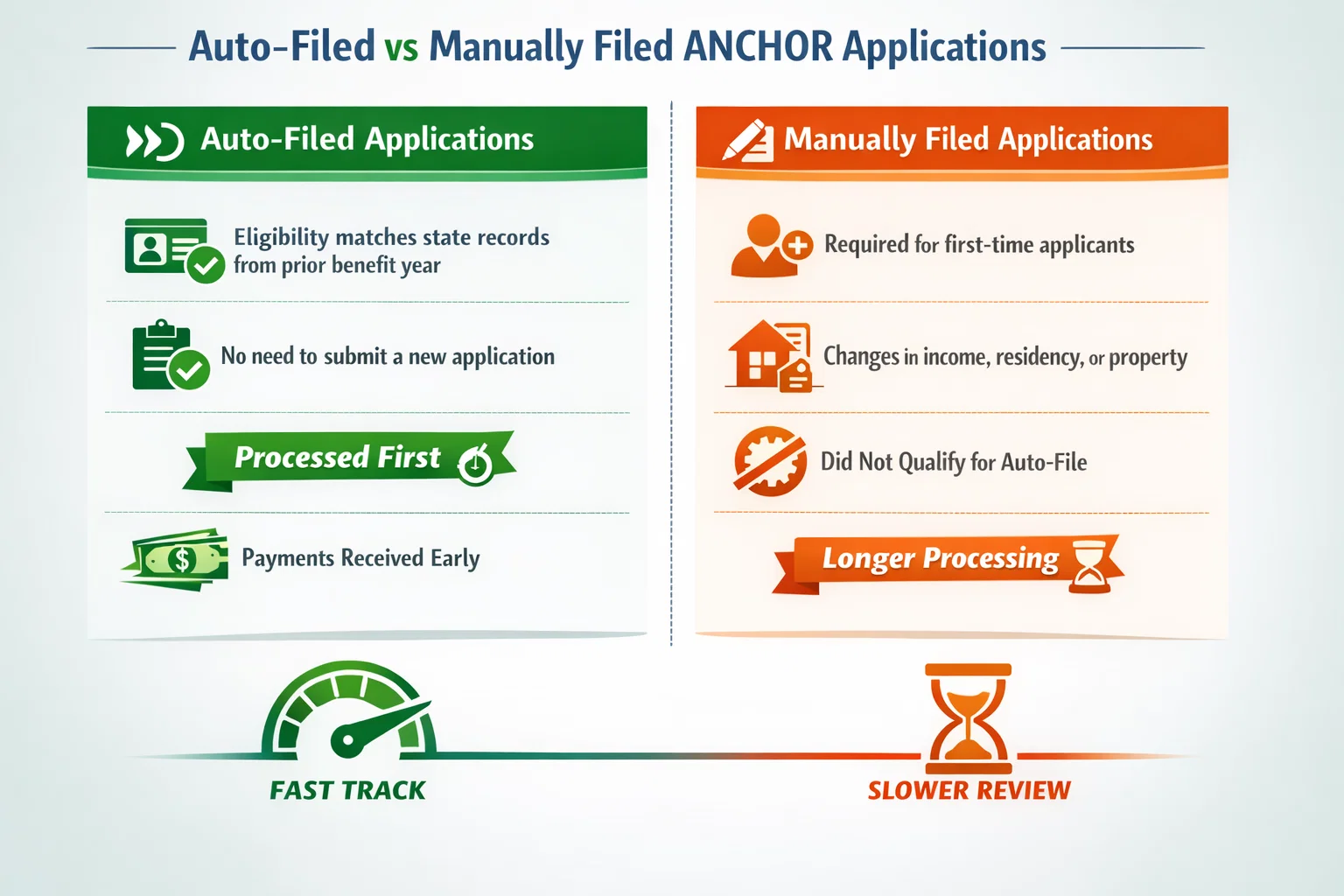

Auto-Filed vs Manually Filed ANCHOR Applications

Auto-Filed Applications

Auto-filed applicants are individuals whose eligibility information matches state records from a prior benefit year. These applicants typically:

- Do not need to submit a new application

- Are processed first

- Receive payments earlier in the cycle

Manually Filed Applications

Manual filing is required for:

- First-time applicants

- Applicants with changes in income, residency, or property status

- Individuals who did not qualify for auto-file

Manually filed applications require additional review, which often results in longer processing times.

How ANCHOR Payments Are Issued

ANCHOR payments are issued in batch-based processing, meaning payments are sent out in groups rather than individually as soon as they are approved.

- Direct deposit (if banking information is on file)

- Paper check mailed to the address on record

Payment method is determined by the information provided during filing or from prior records. Incorrect bank details or outdated addresses can delay delivery or result in returned payments.

If a payment cannot be successfully delivered, the application may require manual intervention before reissuance.

Why Your ANCHOR Payment May Be Delayed

Delays are common and do not necessarily mean your application was denied. Common reasons include:

- Incorrect or incomplete application information

- Identity verification or income matching reviews

- Address or bank account mismatches

- High seasonal filing volume

- Returned checks or failed direct deposits

Applicants requiring additional verification are typically processed later than standard applications.

What to Do If Your ANCHOR Payment Was Issued but Not Received

If your status shows that a payment was issued but you have not received it:

- Allow sufficient mailing or bank processing time

- Confirm your address or banking details are correct

- Check for returned mail or rejected deposits

- Contact the New Jersey Division of Taxation for next steps

Lost checks or failed deposits may require a payment trace and reissuance.

For additional support with tax matters, What is the penalty for late payment of taxes in NJ? provides important compliance information.

The Future of the ANCHOR Program

A common question among New Jersey residents is, "Will ANCHOR be yearly?" The program has evolved significantly since its inception, and its long-term sustainability is a topic of ongoing discussion among policymakers. Understanding the history of NJ property tax relief reveals a pattern of programs designed to provide financial assistance, with the ANCHOR program being the latest and most comprehensive iteration. For current information on what is anchor tax relief in nj, residents can access detailed explanations of program benefits.

Historically, New Jersey has implemented various property tax relief initiatives, such as the Homestead Benefit. The evolution of ANCHOR program from these predecessors reflects a continuous effort to refine and expand support for homeowners and renters.

While the program has been a significant success, its future, including whether it will become a permanent annual fixture, often depends on state budget considerations and legislative changes ANCHOR.

Discussions around the future of NJ tax relief often involve debates about annual vs. one-time payments. Many residents prefer the predictability of annual benefits, which provide a more stable form of financial planning.

The impact of state elections on ANCHOR and other tax relief programs can also be a factor, as new administrations may prioritize different fiscal policies.

For those seeking ongoing financial guidance, retirement planning in NJ services can help integrate tax benefits into long-term financial strategies.

Staying informed about official announcements and legislative updates from the New Jersey Department of Treasury is crucial for understanding the program evolution and any potential changes that might affect future benefits.

Related NJ Rebate Programs

New Jersey offers other property tax relief programs that follow different eligibility rules and payment schedules.

These include programs such as Senior Freeze and Stay NJ, which are designed for specific groups and are processed separately from ANCHOR. Each program has its own filing requirements, income limits, and payment timelines, and payments are not issued at the same time as ANCHOR benefits.

If you are looking for a complete breakdown of all New Jersey rebate programs, including ANCHOR, Senior Freeze, and Stay NJ, along with detailed payment timelines and tracking instructions, see our full guide:

When can I expect my NJ rebate check?

This resource provides a side-by-side overview to help you understand which program applies to you and when you can expect payment, without confusion between benefit types.

Conclusion

The NJ ANCHOR Program stands as a vital lifeline for New Jersey homeowners and renters, offering much-needed property tax relief. While the process of receiving your ANCHOR payment can sometimes feel complex, armed with the right information, you can confidently navigate every step.

From understanding eligibility and application procedures to tracking your payment and troubleshooting common issues, being informed is your greatest asset.

We hope this comprehensive guide has empowered you with the knowledge to manage your ANCHOR benefits effectively. Stay proactive by checking official sources, understanding the payment timelines, and knowing who to contact if you encounter any challenges.

Your New Jersey property tax relief is a significant benefit, and you deserve to receive it smoothly and efficiently. For comprehensive financial management, including bookkeeping services in new Jersey and other professional services, expert assistance is always available to help you maximize your tax benefits.

ANCHOR eligibility rules, payment timelines, and benefit amounts are subject to annual state budget approval and legislative changes. Information provided here is based on guidance from the New Jersey Division of Taxation and may change each benefit year.

ANCHOR Payment FAQ: Your Questions Answered

How long does it take to receive an ANCHOR payment?

Most eligible applicants receive payment within approximately 90 days, though timing varies.

Are ANCHOR payments issued all at once?

No. Payments are issued on a rolling, batch-based schedule.

Do auto-filed applicants get paid first?

Yes. Auto-filed applications are typically processed before manual filings.

Can filing errors delay my payment?

Yes. Even minor errors can trigger additional review and delay payment.

Is ANCHOR paid every year?

ANCHOR is subject to state budget approval and legislative decisions. Annual payments are not guaranteed.

How will I know if my payment was approved?

You can track approval and payment status through the NJ Division of Taxation’s ANCHOR status checker.

What does “Under Review” mean on my NJ ANCHOR status?

“Under Review” means the New Jersey Division of Taxation is verifying your application details, including identity, residency, and income. No action is needed unless the state contacts you for additional information.

How long after ANCHOR status shows “Approved” will I get paid?

Once your status is “Approved,” payments are issued in batch-based processing. Direct deposits usually arrive within 5–10 business days, while paper checks may take 2–4 weeks.

Why does my ANCHOR status say “Issued” but no payment yet?

“Issued” means your payment has been processed but not necessarily received. Status update delays can occur due to mailing, bank processing, or verification issues. A payment trace may be required if funds are not received after the expected timeframe.

How often does NJ update ANCHOR payment status?

The NJ Division of Taxation updates payment status in batches. Status changes may not appear immediately, and it can take several days after approval or issuance for your account to reflect the latest information.

Can filing errors delay my ANCHOR payment?

Yes. Even minor errors or missing information can trigger additional manual verification, delaying payment. Always ensure your application is complete and accurate.

What should I do if my ANCHOR check is lost or my direct deposit failed?

A: First, confirm your banking details or mailing address. If payment is missing despite “Issued” status, contact the NJ Division of Taxation to initiate a payment trace or request reissuance.

Are ANCHOR payments guaranteed every year?

No. ANCHOR payments are subject to annual state budget approval and legislative changes. Payment amounts and timelines may vary each benefit year.

Who can I contact for help with my ANCHOR payment?

The New Jersey Division of Taxation is the primary contact for any ANCHOR-related inquiries. Have your Social Security Number and application details ready for quicker assistance.

Why is my ANCHOR payment delayed?

Several factors can contribute to delays in your ANCHOR payment. Common reasons include high application volume, especially during peak processing periods, or issues with your application itself. This could be due to incomplete information, errors in the data submitted, or missing required documentation.

The New Jersey Division of Taxation processes a vast number of applications, and sometimes backlogs can occur.

What should I do if my ANCHOR check is lost or my direct deposit failed?

If your ANCHOR check is lost or your direct deposit did not go through, it's crucial to take action. First, verify your payment status using the official online tracking system on the NJ Division of Taxation website. If the status indicates the payment was issued but you haven't received it, you should contact the New Jersey Division of Taxation directly.

They can provide guidance on how to report a missing payment, initiate a trace for a direct deposit, or request a reissuance of a lost check. Be prepared to provide your Social Security Number and other identifying information.

How can I verify information or correct errors on my ANCHOR application?

If you suspect there are errors in your ANCHOR application or if you need to update personal information, it's best to contact the New Jersey Division of Taxation as soon as possible.

They can guide you through the process of verifying your submitted information and making any necessary corrections. Promptly addressing these issues can prevent further delays in receiving your payment.

What if my ANCHOR application is denied, or the benefit amount is incorrect?

If your ANCHOR application is denied, or you believe the benefit amount you received is incorrect, you have the right to appeal the decision. The process for appealing denied benefits typically involves submitting a formal appeal to the New Jersey Division of Taxation with supporting documentation that substantiates your claim.

It's important to clearly outline why you believe the decision should be reconsidered and provide any relevant evidence. You can find information on the appeal process on the official NJ Division of Taxation website or by contacting them directly for specific instructions.

Who should I contact for specific issues or questions about my ANCHOR payment?

For any specific issues or questions regarding your ANCHOR payment, the primary point of contact is the New Jersey Division of Taxation. They have dedicated channels for inquiries related to the ANCHOR program.

You can typically find their contact information, including phone numbers and potentially email addresses or in-person assistance options, on their official website. When contacting them, have your Social Security Number and any relevant application details ready to facilitate a quicker resolution.

Related Articles

Services provided for you

Bookkeeping Services in Clifton, NJ

We serve a range of industries and customers, in an organized, friendly, and reliable way.

Business Tax Services

We are in a position to identify tax planning shots that reduce both your current and future tax liabilities.

Individual Tax Services

We gauge our worth by the personal and business successes of our clients and industries.

Payroll Services

For small and large corporations, payroll systems, highly qualified payroll experts support our services. Our primary objective is to provide customized services and highly favorable pricing for you.

Non-Profit Organization Services

Precision Accounting Intl can assist you set up and maintain your non-profit organizations nontaxable standing by handling all the authority reportage for you.

Part-Time CFO Services

If you"re ready enough to be in this role. Our Part-Time CFO Service Package provides you with a knowledgeable financial manager who will work with you to help guide the progress of your business.