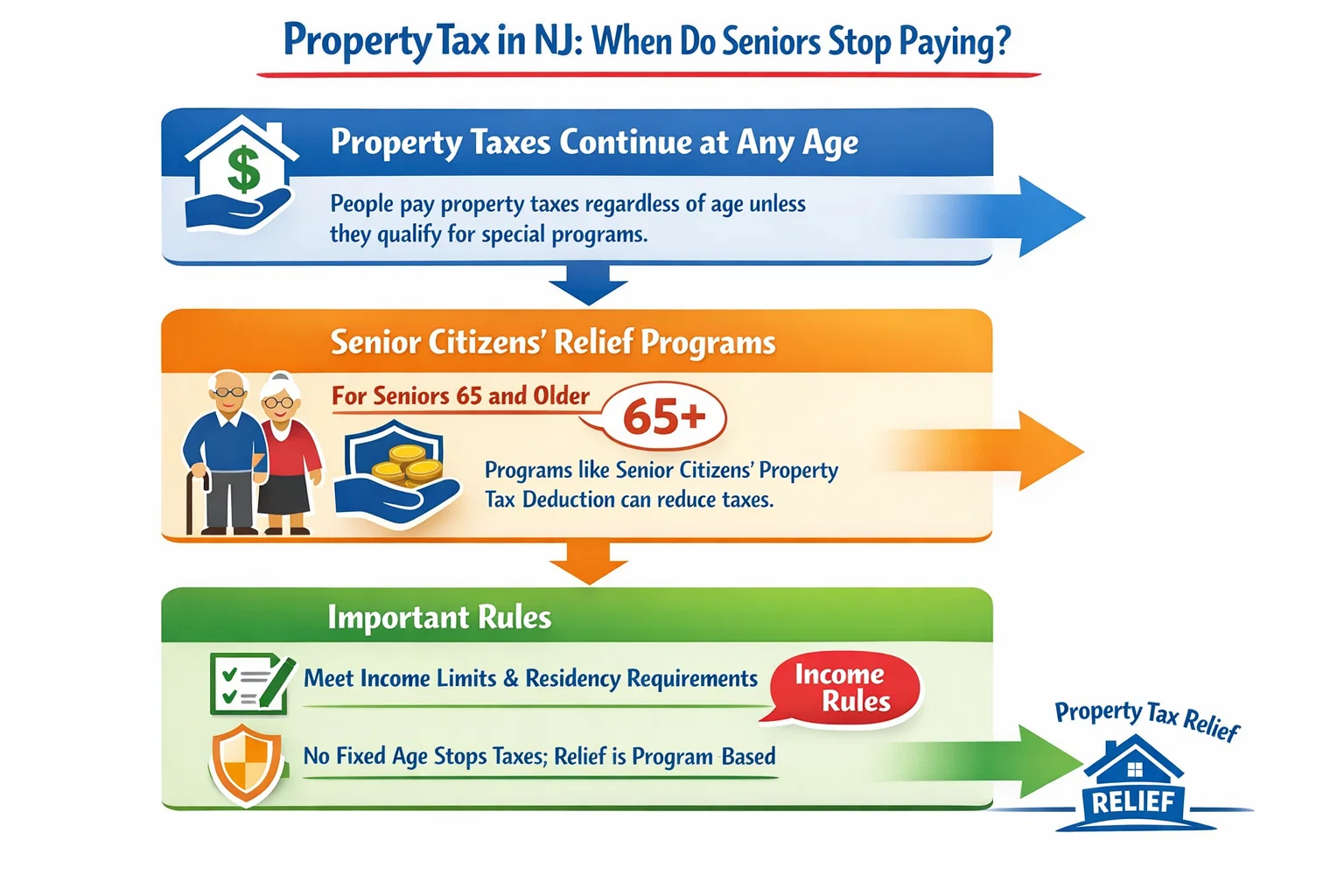

While many seniors wonder if there’s a specific age when property taxes end in New Jersey, the answer is no, property taxes continue regardless of age. However, Residents aged 65 and older can significantly reduce or recover their property taxes through programs such as Senior Freeze, ANCHOR, and Stay NJ, all accessed through the NJ SAVE program.

This guide explains:

- How each program works in 2025/2026

- Eligibility criteria and income limits

- Payment timelines and amounts

- Social Security tax rules in NJ

- Local property tax rates across major New Jersey cities

By understanding these programs, seniors and other eligible residents can maximize relief and plan their finances effectively.

For expert help, find a tax accountant in NJ who understands local senior tax relief programs.

At what age do you stop paying property tax in NJ?

Seniors aged 65 and older might find property tax relief. They can get help through programs like the Senior Citizens' Property Tax Deduction. This can make their property taxes lower.

While there's no fixed age to stop paying property taxes, seniors 65 and older might get some relief.

Find:

- Tax relief services near you in Clifton NJ

- Who is eligible for the NJ property tax relief credit?

- When can I expect my NJ rebate check?

NJ Property Tax Relief Programs 2025/2026

New Jersey offers several programs to help residents lower their property tax burden:

| Program | Purpose | 2025/2026 Payment Timeline | Maximum Benefit |

| Senior Freeze (Property Tax Reimbursement) | Reimburses eligible seniors for property tax increases on their principal residence | Payments began July 15, 2025, and continue on a rolling schedule | Varies based on previous year’s tax increase |

| ANCHOR (Affordable New Jersey Communities for Homeowners & Renters) | Provides rebates to homeowners and renters based on income | Payments started September 15, 2025, and continue on a rolling basis | Homeowners: up to $1,750; Renters: up to $450 |

| Stay NJ Program | Quarterly property tax relief for eligible residents | Q1 2026 and subsequent quarters | Varies per household |

Tip: Collect all required documents early, including proof of age, residency, income, and property deeds, to ensure timely processing.

Read also:

For direct assistance with NJ property tax relief programs like Senior Freeze or Stay NJ, contact the NJ Division of Taxation at 1‑888‑238‑1233.

What Is the NJ SAVE Program (PAS-1 Combined Application) in New Jersey?

The NJ SAVE program (New Jersey State Application for Property Tax Relief) is not a separate tax benefit, but a single, combined application system used by the State of New Jersey to determine eligibility for multiple property tax relief programs.

NJ SAVE simplifies the process for seniors, homeowners, and eligible residents by allowing them to apply once for several programs instead of submitting separate forms.

The NJ SAVE program uses the PAS-1 form, a combined application that allows eligible residents to apply for multiple New Jersey property tax relief programs through a single application.

When you file through the NJ SAVE (PAS-1) application, the state automatically evaluates eligibility for:

- Senior Freeze (Property Tax Reimbursement)

- ANCHOR Property Tax Relief

- Stay NJ Program

- Senior Citizens / Disabled Persons Property Tax Deduction ($250)

How the NJ SAVE PAS-1 Form Works

Instead of filing separate paperwork for each benefit, the PAS-1 form functions as a single application, meaning residents submit one combined application that is reviewed for Senior Freeze, ANCHOR, Stay NJ, and the senior property tax deduction at the same time.

Senior Freeze: Eligibility, Payments & How It Works

To qualify for the Senior Freeze, residents must meet these requirements:

| Eligibility Criteria | Details |

| Age | 65 years or older |

| Residency | Must live in NJ and occupy the property as primary residence |

| Income Limit | $163,050 gross income for 2025/2026 |

| Ownership | Must own and occupy the home |

| Application | Annual PAS‑1 form submission by April 1 |

How Payments Work:

- New Jersey reimburses eligible seniors for the difference between their current year property taxes and a “base year” amount.

- Payments are processed on a rolling schedule starting July 15, 2025.

- Seniors receive a check or direct deposit based on municipality processing times.

Expert Tips:

- Keep copies of prior property tax bills to validate reimbursement calculations.

- Eligible homeowners do not apply for Senior Freeze separately; eligibility is determined through the NJ SAVE PAS-1 combined application submitted annually.

Program Highlights:

- Senior Citizen Property Tax Deduction: Reduces property tax liability by up to $250 for eligible homeowners.

- Senior Freeze (Property Tax Reimbursement): Reimburses seniors for increases in property taxes on their primary residence; payments began July 15, 2025, and continue on a rolling schedule.

- ANCHOR Benefit: Provides rebates for eligible homeowners (up to $1,750) and renters (up to $450); payments began September 15, 2025.

- Stay NJ Program: Offers quarterly property tax relief for seniors, distributed in February, May, August, and November 2026, helping residents manage cash flow throughout the year.

Factors Influencing Property Tax Amounts:

- Property Value: Higher-value homes generally have higher taxes.

- Local Laws & Budgets: Municipal budgets, school funding, and voter-approved levies impact tax rates.

- Market Trends & Economy: Home values can fluctuate with local real estate trends, affecting annual assessments.

Local Examples:

- Residents in Newark, Jersey City, Clifton, Paterson, and Trenton face some of the highest property tax rates in NJ, making these programs especially valuable.

- Understanding your municipality’s assessment process ensures accurate filings and maximizes benefits.

Additional Notes for Seniors:

- New Jersey does not tax Social Security benefits, allowing seniors to combine income from Social Security with property tax relief programs for greater financial stability.

- Keeping organized financial records and consulting a trusted NJ tax accountant can help seniors avoid penalties and ensure they claim all eligible benefits.

- Seniors running small businesses or managing rental income should consider services like business tax planning and bookkeeping in Clifton, NJ to stay compliant while optimizing deductions.

Tip: Apply early, track deadlines, and reapply each year to ensure uninterrupted relief. Proper planning allows seniors to maximize property tax discounts, stay within income limits, and maintain a secure retirement.

Other programs help seniors

These programs help seniors and disabled people. It's important for seniors to know about these programs. They need to meet certain income and residency rules.

ANCHOR Benefit: Who Gets It & When Payments Arrive

The ANCHOR program helps eligible residents with property tax relief or rebates.

| Program Feature | Details |

| Eligibility | NJ residents, homeowners and renters, income below program thresholds |

| Maximum Benefit | Homeowners: $1,750; Renters: $450 |

| Payment Start Date | September 15, 2025, and ongoing |

| Application | Through PAS‑1 combined form or online submission |

| Income Limits | Homeowners ≤ $150,000 gross income; Renters ≤ $150,000 gross income |

How to Apply:

- Complete the PAS‑1 application, ensuring all documents (proof of income, age, residency) are included.

- Submit to your local tax assessor or online via the NJ Division of Taxation portal.

- Track ANCHOR payment status online or contact your county office for updates.

Tips:

- If you applied last year, verify whether you need to resubmit for 2025/2026, you can also Check the anchor check status.

- ANCHOR benefits are issued after eligibility is confirmed through the PAS-1 form, which serves as the single application for NJ property tax relief programs.

Calculate your benefit, explore how much anchor tax relief NJ you may be eligible for.

You can find required documents, including IRS tax forms and publications, on our site to assist with filing.

Stay NJ Program: Quarterly Property Tax Relief for 2026

The Stay NJ Program provides quarterly property tax relief to eligible New Jersey residents. Unlike ANCHOR or the Senior Freeze, which issue annual or rolling payments, Stay NJ distributes funds in four installments throughout the year, helping residents manage their tax burden more evenly.

Eligibility Criteria:

- Must be a New Jersey resident and property owner

- Must meet income limits as defined for the 2025/2026 tax year

- Primary residence must be located in New Jersey

Payment Schedule for 2026:

- Q1: February

- Q2: May

- Q3: August

- Q4: November

Key Points:

- Payments vary based on household income, property value, and municipality.

- Residents must file the PAS‑1 combined application to access all property tax relief programs, including Stay NJ.

- The program helps seniors and eligible residents spread out property tax relief across the year, improving financial planning and cash flow.

- To receive Stay NJ quarterly payments, residents must file the PAS-1 combined application as part of the NJ SAVE program.

Tip: Ensure all supporting documents—proof of income, residency, and ownership—are submitted with your application to avoid delays in receiving quarterly payments.

Current NJ Property Tax Rates: Statewide & Major Cities

New Jersey property tax rates vary widely depending on the municipality. Below is a comparison of median effective property tax rates and estimated taxes for a home valued at $250,000 in 2025/2026:

| City / Location | Median Effective Tax Rate | Example $250,000 Home | Notes |

| Statewide NJ Average | ~2.23% | ~$5,575 | Overall NJ benchmark |

| Newark | ~2.06% | ~$5,150 | High-tax urban city |

| Jersey City | ~2.30% | ~$5,750 | Urban center estimate |

| Paterson | ~2.40% | ~$6,000 | Passaic County city |

| Elizabeth | ~2.40% | ~$6,000 | Essex County urban city |

| Clifton | ~2.30% | ~$5,750 | Northern NJ city |

| Camden | ~3.08% | ~$7,700 | South Jersey city |

| Trenton | ~2.60% | ~$6,500 | Capital city |

| Egg Harbor Township (Atlantic County) | ~2.47% | ~$6,175 | Southern NJ township |

| Millburn, NJ (Essex County) | ~1.07% | ~$2,675 | Affluent suburban township |

| Monmouth County, NJ (county average) | ~1.77% | ~$4,425 | Coastal county median |

| Essex County, NJ (county average) | ~2.02% | ~$5,050 | Key comparator region |

| Bergen County, NJ (county average) | ~1.69% | ~$4,225 | Northern NJ high-value county |

| Warren County, NJ (county average) | ~2.52% | ~$6,300 | County-wide comparison |

| Blairstown, NJ (Warren County) | ~2.88% | ~$7,200 | Local Warren County town |

Notes:

- Property taxes differ due to municipal budgets, school funding, and assessment practices.

- Example figures illustrate potential tax bills; actual assessments may vary.

- Higher-tax cities like Newark and Trenton benefit more from programs like ANCHOR and Senior Freeze.

Tips for seniors:

- Compare your home’s assessed value with similar properties in your city.

- Apply for local city or county exemptions if available.

- Track annual tax assessments to plan relief applications accurately.

How to Pay Your NJ Property Taxes Online

Paying property taxes online in New Jersey is fast, secure, and keeps your records organized, especially important if you’re applying for programs like Senior Freeze, ANCHOR, or Stay NJ. Here’s how to do it step by step:

Step 1: Find Your Municipal Tax Portal

- Go to your city or township website (e.g., Clifton, Newark, Egg Harbor Township).

- Write on Google “your city + Municipal Tax Portal”

Step 2: Gather Your Property Information

- Have your tax bill handy. You will need:

- Block and Lot Number

- Tax Account Number

- Property Owner Name

- Some portals allow payment with just your street address.

Step 3: Choose Your Payment Method

- Most portals accept:

- Credit/Debit Cards (may include a small convenience fee)

- Electronic Bank Transfer (ACH/eCheck) (usually no fee)

- Decide whether you want a one-time payment or set up recurring payments if offered.

Step 4: Enter Payment Details

- Input the amount you want to pay. You can pay the full tax bill or a portion, if allowed.

- Double-check your property information and payment amount.

Step 5: Confirm and Submit

- Review your payment carefully.

- Click Submit / Pay Now.

- Save or print your digital receipt. You may need this for tax relief program documentation.

Step 6: Verify Payment

- Check your bank account or credit card to ensure the payment went through.

- If your municipality offers a confirmation portal, log in to confirm your payment status.

Practical Tips:

- Schedule early: Payments made before the due date avoid late fees.

Does New Jersey Tax Social Security Benefits?

Many retirees in New Jersey wonder if Social Security income affects their state taxes. The answer is:

- New Jersey does not tax Social Security retirement benefits. Residents can receive Social Security income without any state income tax on these benefits.

- This exemption applies regardless of age, so seniors 65+ who are receiving Social Security will not pay NJ state tax on it.

- Federal taxation of Social Security may still apply depending on total income, but NJ does not impose an additional tax.

- Knowing this helps seniors plan their retirement income alongside property tax relief programs, like Senior Freeze, ANCHOR, and Stay NJ, to maximize financial benefits.

Tip: For retirees combining Social Security with other income, calculate overall tax liability to understand which relief programs (property tax credits, deductions, or rebates) provide the most benefit.

Learn how to maximize your property tax deduction in NJ as a senior.

Property Tax Relief Payment Timelines - 2025/2026

| Program | 2025/2026 Timeline |

| Senior Freeze (Property Tax Reimbursement) | Payments began July 15, 2025, on a rolling schedule |

| ANCHOR Benefit | Payments started September 15, 2025, and continue on a rolling basis |

| Stay NJ Program | Quarterly payments begin in 2026 (Feb, May, Aug, Nov) |

Important Notes:

- The deadline to file PAS‑1 combined applications for ANCHOR, Senior Freeze, and Stay NJ for 2025/2026 was October 31, 2025.

- Most payments are processed on a rolling basis — timing of submission can influence when you receive benefits.

Stay NJ quarterly disbursements are budget-dependent and tied to the New Jersey Fiscal Year 2026.

Understanding NJ Property Tax Assessment for Seniors

The NJ property tax assessment for seniors is key to figuring out their yearly property taxes. It's about how much a property is worth, which affects how much tax is owed. For seniors, knowing this is vital for planning their finances and managing taxes.

Property values depend on many things like where it's located, its size, condition, and what similar homes sell for. A fair assessment means seniors pay the right amount of taxes. If they think their assessment is too high, they can appeal it to the local tax assessor's office.

Seniors should check their property's assessment often and know their rights. If they think their property's value is off, they can gather evidence to support their claim. This way, they can make smart choices about their property taxes.

| Assessment Factor | Description | Impact on Property Taxes |

| Location | Desirability and amenities in the area | Higher location desirability may increase property value |

| Property Size | Total square footage and number of rooms | Larger properties generally assessed at a higher value |

| Condition | Quality and maintenance of the property | Well-maintained properties may have a higher assessment |

| Comparable Sales | Sales data of similar properties in the area | Affects the benchmark for property value assessment |

Resources & Services you may interested in:

- New Jersey tax accountant.

- Small business accountant NJ.

- Why outsource bookkeeping services in NJ?

- Are bookkeeping services taxable?

- What is bookkeeping service?

- Types of bookkeeping services.

- Small business bookkeeping checklist .

- How to do bookkeeping for NJ restaurants?

- What is QuickBooks?

- Part-time CFO services

- How much is $250,000 after tax in NJ to better plan retirement income.

- Accountant for small business

- What is the due date for payment of tax

- Penalty for late payment taxes NJ

- Retirement planning near you

- Bookkeeping services in Clifton NJ

- Business tax services in NJ

- Type of NJ accountant best for small business can improve your financial outlook.

- What is bookkeeping service in NJ?

- IRS tax rates table

- Rrecord retention guidelines

Conclusion

Property tax rules in NJ help seniors who have given back to their communities. It's key to know these rules, as they offer exemptions, deductions, and refund programs for older residents. Knowing about property tax obligations is important for financial health.

The NJ property tax relief fund plays a key role in easing burdens for seniors. Seniors in New Jersey should look into relief programs like the Senior Citizen Property Tax Deduction and the Senior Tax Freeze. These programs can lessen the financial strain of property taxes. This guide covers the key points about property tax rules for seniors in NJ, helping to ease these burdens.

As property taxes change, it's important for seniors to check if they qualify for programs. By finding the right opportunities and understanding how to apply, they can keep their financial responsibilities in check during retirement.

Seniors looking for dependable support should consider top accounting firms in NJ like ours, experienced in state-specific deductions and relief programs.

FAQ

What is the PAS-1 form in New Jersey?

The PAS-1 form is the NJ SAVE combined application used to apply for Senior Freeze, ANCHOR, Stay NJ, and the senior property tax deduction through a single application.

Do I need to file separate applications for Senior Freeze and ANCHOR?

No. Both programs are accessed through the PAS-1 single application under the NJ SAVE program.

Does PSEG offer senior discounts?

While PSEG (Public Service Enterprise Group) does not offer a universal “senior discount,” eligible low-income customers may qualify for utility assistance or budget billing programs. Seniors should contact PSEG customer support or visit the official NJ utility assistance page for details.

What is the NJ mansion tax?

The NJ mansion tax is a one-time tax applied to real estate transactions for properties sold at $1 million or more. The rate is 1.0% of the sale price, paid at closing.

Who is eligible for the Stay NJ Program?

Eligibility for Stay NJ is determined through the NJ SAVE (PAS-1) combined application and generally requires NJ residency, primary home ownership, and income within established limits. Seniors, disabled homeowners, and other qualified residents may receive quarterly tax relief.

How are property taxes calculated in NJ?

New Jersey property taxes are based on assessed value multiplied by the local tax rate (millage). Assessments reflect market value, and millage rates vary by municipality and county.

What is the NJ taxation phone number?

For property tax relief program inquiries and assistance with NJ SAVE or the PAS-1 form, contact the NJ Division of Taxation at the official NJTaxation customer service number (list the correct number here after fact-checking on the NJ government site).

Can I pay NJ property taxes online?

Yes. Most municipalities, including major cities like Newark, Jersey City, and Clifton, offer online property tax payment portals.

If you bury someone on your property, do you have to pay taxes?

In New Jersey, burying someone on your property does not automatically create a separate tax liability. However, local land use regulations may apply, and property classification could change depending on cemetery designation. Contact your municipal tax assessor for specifics.

Unity property tax increase, what does it mean?

“Unity property tax increase” typically refers to a change in assessed value or tax rate that affects how much property tax a homeowner pays. This can occur when local budgets or assessments change.

At what age do you stop paying property tax in NJ?

In New Jersey, property taxes are required regardless of age. However, residents aged 65 and older may qualify for programs like the ANCHOR property tax relief, which offers rebates to eligible seniors.

What property tax exemptions are available in New Jersey?

New Jersey offers several property tax relief programs, including the ANCHOR Benefit, Senior Freeze (Property Tax Reimbursement), and deductions for senior citizens, disabled persons, and veterans. Each program has specific eligibility criteria.

How can seniors apply for property tax relief in NJ?

Seniors can apply for property tax relief through a single combined application that covers the Senior Freeze, ANCHOR, and Stay NJ programs. This application is available online through the New Jersey Division of Taxation's website.

What is the Senior Citizen Property Tax Deduction in NJ?

Qualified senior citizens aged 65 and older may be eligible for an annual property tax deduction of $250. This deduction reduces the overall property tax liability for eligible homeowners.

What is the Senior Tax Freeze Program in NJ?

The Senior Freeze (Property Tax Reimbursement) Program reimburses eligible senior citizens and disabled persons for property tax increases on their principal residence, effectively "freezing" their property taxes at a base year amount.

What are the income limits for property tax relief for seniors in NJ?

Income limits for property tax relief programs vary. For the Senior Freeze Program, the income limit was $150,000 for 2022 and $163,050 for 2023. These limits are subject to change, so it's important to consult the latest state guidelines.

How can seniors challenge or appeal property tax assessments in NJ?

Seniors can appeal property tax assessments by filing a petition with their county Board of Taxation. This must be done within a specific timeframe after receiving the assessment notice, and providing supporting evidence is crucial for a successful appeal.

Are there property tax discounts available for seniors in NJ?

Yes, in addition to the Senior Freeze and ANCHOR programs, eligible seniors may receive a $250 property tax deduction. These programs aim to reduce the property tax burden for qualifying senior homeowners.

What documentation is required to apply for property tax relief programs in NJ?

Applicants typically need to provide proof of age, income, residency, and property ownership. Specific documentation requirements vary by program, so reviewing the application instructions carefully is essential.

How do property values impact property tax obligations for seniors in NJ?

Property values directly influence property tax amounts; as property values increase, taxes may rise accordingly. However, programs like the Senior Freeze can help stabilize property taxes for eligible seniors by reimbursing them for increases.

Source: https://www.nj.gov/treasury/taxation/relief.shtml

Related Articles

Services provided for you

Bookkeeping Services in Clifton, NJ

We serve a range of industries and customers, in an organized, friendly, and reliable way.

Business Tax Services

We are in a position to identify tax planning shots that reduce both your current and future tax liabilities.

Individual Tax Services

We gauge our worth by the personal and business successes of our clients and industries.

Payroll Services

For small and large corporations, payroll systems, highly qualified payroll experts support our services. Our primary objective is to provide customized services and highly favorable pricing for you.

Non-Profit Organization Services

Precision Accounting Intl can assist you set up and maintain your non-profit organizations nontaxable standing by handling all the authority reportage for you.

Part-Time CFO Services

If you"re ready enough to be in this role. Our Part-Time CFO Service Package provides you with a knowledgeable financial manager who will work with you to help guide the progress of your business.