If you are living in Egypt and earning income from the United States — whether through remote work, investment, property ownership, or other financial activities — you may be required to file U.S. taxes. But if you’re not eligible for a Social Security Number (SSN), you’ll need to apply for an Individual Taxpayer Identification Number (ITIN) using Form W-7.

At Precision Accounting Intl, we help individuals and businesses in Egypt complete the Form W-7 process quickly, securely, and without sending their original passport to the U.S. Our goal is to make U.S. tax compliance simple, transparent, and fully IRS-compliant for international taxpayers.

Visit our main service page to learn more: ITIN Services in Egypt.

What Is Form W-7 and Why It Matters

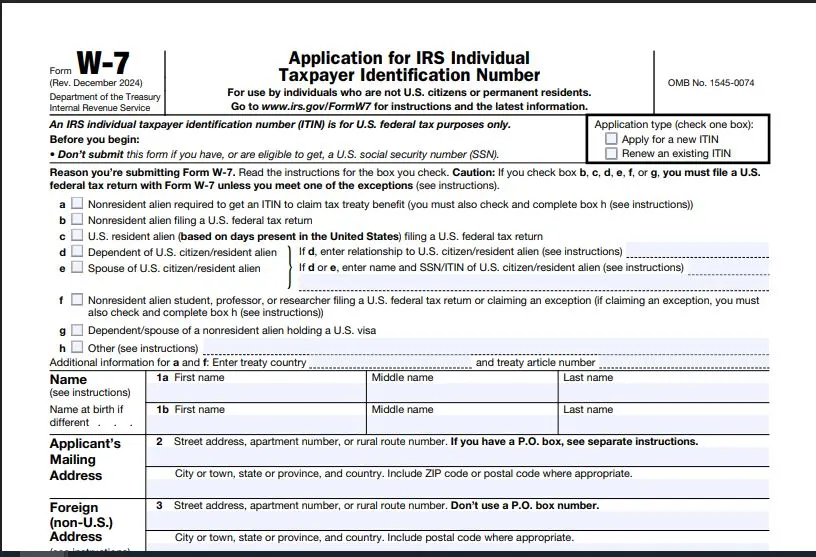

Form W-7 is an IRS document used to apply for an ITIN, a tax processing number for individuals who aren’t eligible for a Social Security Number but still need to file U.S. tax returns or report income to the IRS.

An ITIN allows you to:

- File U.S. federal tax returns

- Claim tax treaty benefits

- Receive U.S. tax refunds

- Open and maintain U.S. bank accounts

- Receive payments from U.S. companies or platforms

To learn more about what an ITIN is and why it’s required, read our detailed guide: What Is ITIN Service in Egypt.

Who Should File Form W-7?

You should submit Form W-7 if you are:

- A non-U.S. resident required to file a U.S. tax return

- A dependent or spouse of a U.S. citizen or resident alien

- A foreign investor, business owner, or freelancer earning U.S.-sourced income

- A student, researcher, or academic receiving stipends or grants from the U.S.

If you are unsure whether you qualify, our article Who Can Apply for ITIN in the USA from Egypt explains eligibility in full detail.

Required Documents for Form W-7

When completing Form W-7, the IRS requires proof of both your identity and foreign status. The following documents are typically accepted:

- Valid passport (the only stand-alone document)

- Or a combination of:

- National ID card

- Birth certificate

- U.S. visa

- Foreign driver’s license

- Other government-issued documents

All documents must be original or certified copies issued by the relevant government authority. At Precision Accounting Intl, we handle document verification for you, ensuring that your ITIN application meets IRS verification standards to prevent rejections or delays.

How to File Form W-7 from Egypt

At Precision Accounting Intl, we simplify the entire Form W-7 process for individuals, investors, and business owners in Egypt who need an ITIN to meet their U.S. tax obligations. Our service is designed to save you time, eliminate confusion, and protect your original documents while ensuring complete compliance with IRS standards.

Here’s how our step-by-step ITIN service works:

1- Personalized Eligibility Review

Our ITIN specialists carefully review your situation to confirm your eligibility for an ITIN under IRS guidelines. Whether you are applying for the first time or renewing an expired ITIN, we determine the correct category and supporting documents required for your case.

2- Professional Form W-7 Preparation

Once eligibility is confirmed, our team accurately completes Form W-7 for you, ensuring that every field and supporting document meets IRS specifications. We take care of all form details, from selecting the correct reason for application to ensuring consistency with your passport or ID records.

3- Identity Verification in Egypt

As a trusted IRS-authorized Certifying Acceptance Agent (CAA), Precision Accounting Intl can verify your identity locally in Egypt — meaning you don’t need to send your original passport to the United States. We certify your documents and attach them directly to your ITIN application, guaranteeing authenticity and security.

4- IRS Submission and Tracking

After verification, we prepare and submit your full ITIN application package directly to the IRS ITIN Operations Center. Our team continuously tracks your submission status, providing updates until your ITIN is officially issued.

5- Post-Approval Support

Once your ITIN is approved, we continue to support you with any additional IRS requirements, from using your new ITIN to file U.S. taxes to renewing it before expiration.

With Precision Accounting Intl, you’re not just getting help filling out a form — you’re getting a complete, end-to-end ITIN solution managed by professionals who understand both U.S. and Egyptian documentation standards.

Learn more about our ITIN Services in Egypt and how we can handle your Form W-7 application from start to finish — securely, accurately, and locally.

For a full breakdown of the application process, check our detailed post: How to Apply for a U.S. ITIN in Egypt.

Processing Time for Form W-7

Once submitted, Form W-7 applications generally take between 6 to 12 weeks for the IRS to process. However, during the U.S. tax season (January through April), it may take longer.

By applying through Precision Accounting Intl, you can avoid delays caused by missing documents, incorrect data, or mailing errors — common issues that affect many self-filed ITIN applications.

Why Choose Precision Accounting Intl for ITIN and Form W-7 Services in Egypt?

Choosing the right professional makes all the difference. At Precision Accounting Intl, we provide a complete ITIN service for non-U.S. residents, investors, freelancers, and families in Egypt who need to comply with IRS rules.

Here’s why clients trust us:

- IRS-Certified Acceptance Agents (CAA) – We’re authorized to verify your documents locally.

- No Passport Mailing – Keep your original passport safe in Egypt.

- Quick and Accurate Filing – Our experts ensure your Form W-7 is error-free and complete.

- Support Beyond Approval – We assist with ITIN renewals, tax filing, and ongoing compliance.

Start Your Form W-7 Application Today

Applying for an ITIN doesn’t have to be stressful or confusing. With Precision Accounting Intl, you can complete Form W-7 securely and professionally — without sending your passport abroad.

Whether you’re a freelancer, investor, or family member of a U.S. resident, we’re here to make the process simple and fully compliant with U.S. tax regulations.

Begin your application today with our ITIN Services in Egypt and let our experts handle the rest.

Related Articles

Services provided for you

Bookkeeping Services in Clifton, NJ

We serve a range of industries and customers, in an organized, friendly, and reliable way.

Business Tax Services

We are in a position to identify tax planning shots that reduce both your current and future tax liabilities.

Individual Tax Services

We gauge our worth by the personal and business successes of our clients and industries.

Payroll Services

For small and large corporations, payroll systems, highly qualified payroll experts support our services. Our primary objective is to provide customized services and highly favorable pricing for you.

Non-Profit Organization Services

Precision Accounting Intl can assist you set up and maintain your non-profit organizations nontaxable standing by handling all the authority reportage for you.

Part-Time CFO Services

If you"re ready enough to be in this role. Our Part-Time CFO Service Package provides you with a knowledgeable financial manager who will work with you to help guide the progress of your business.